Daily Market Analysis and Forex News

2024 US elections: 3 markets to trade

The US elections are more than just political events. Held every four years on the first Tuesday after 1 November, they tend to bring election-related volatility and opportunities in the financial markets.

This year is looking no different.

Traders and investors monitor events like this closely, expecting shifts in policies that can impact everything from stock prices to currency values and commodity prices. And while each election is unique, historical patterns can offer some valuable insight into how different markets tend to react.

In this blog, we'll look at some key markets that are particularly reactive during US elections. Specifically, we’ll consider US stocks, USD currency pairs, and commodities. We’ll also touch on alternative markets and hedging strategies to help you navigate this period of heightened uncertainty.

Let’s dive in.

3 markets to consider trading during US elections

-

The US stock market

The US stock market becomes a focal point during US elections. It’s represented by major indices such as the S&P 500 (FXTM ticker: US500), NASDAQ 100 (FXTM ticker: NAS100), and Dow Jones Industrial Average (FXTM ticker: US30) that track the overall US market performance.

During US elections, market performance can be heavily influenced by investor sentiment, expectations about future economic policies, and the perceived impact of each candidate's platform on different sectors.

Heightened uncertainty often leads to increased volatility in the stock market. The potential for significant policy changes, especially related to taxation, regulation, healthcare, and energy, can cause investors to reassess the value of companies across the sectors that may be affected most.

The election outcomes can directly impact corporate profitability, investor confidence, and overall economic growth expectations, all of which are critical drivers of stock prices.

Trade strategies for US stocks in election years

Two popular strategies to consider when trading US stocks during the election period are sector rotation and volatility trading.

Sector rotation: Traders can focus on sectors and specific stocks expected to benefit from the policies of the leading candidate.

Examples of stocks that may flourish under a Harris administration include:

Green energy stocks:

-

Enphase Energy Inc and Solaredge Technologies Inc: These companies also received government funding under the Biden administration, and with Harris at the helm, likely to continue to benefit from Democrat support of alternative energy and electric vehicle sectors.

EV charging network operators:

-

ChargePoint Holdings: In line with the Democratic push for green policies and following Biden’s objective of 50% of all new vehicle sales being electric by 2030, demand for electric vehicle charging networks is likely to increase, giving these companies a boost in the market.

US manufacturing:

-

Micron: Micron received US$6.14 billion from Biden’s CHIPS and Science Act in April this year to build two new fabricators in New York and Idaho for production of microchips in the US.

-

Eaton Corporation plc: Eaton works in aerospace, vehicles, and e-mobility, and has been highlighted by analysts as one manufacturing stock that could benefit from the Democrats’ focus on electrification.

Stocks that could get a boost from Trump in power are:

Banks:

-

JPMorgan, Goldman Sachs, Bank of America: The typical Republican policy of deregulation allows businesses to operate more freely and with less influence from the government. As such, US banks are likely to make higher profits under a Republican administration. For example, JPMorgan stock saw its biggest increase in value in 20 years during Trump’s presidency in 2019, increasing 42.80%.

Oil and natural gas:

-

Exxon Mobil Corp: Trump is an avid and vocal supporter of the fossil fuels industry. Exxon is the world’s largest investor-owned oil company, and after Trumps’ speech at the Republican National Convention, its stock price rose by 0.2%.

Crypto stocks:

-

Coinbase Global Inc: A third of all cryptocurrency transactions that take place on Coinbase’s trading platform involve Bitcoin. Any rise in Bitcoin value puts Coinbase in a position to benefit, as is the case now that Trump has publicly announced support for the crypto industry.

-

MicroStrategy Inc: MicroStrategy’s shares received a boost after Trump’s appearance at the Bitcoin Conference. The tech company started buying Bitcoin in 2020 and is now the largest corporate holder of the crypto, holding more than 1% of all the Bitcoin that can ever exist.

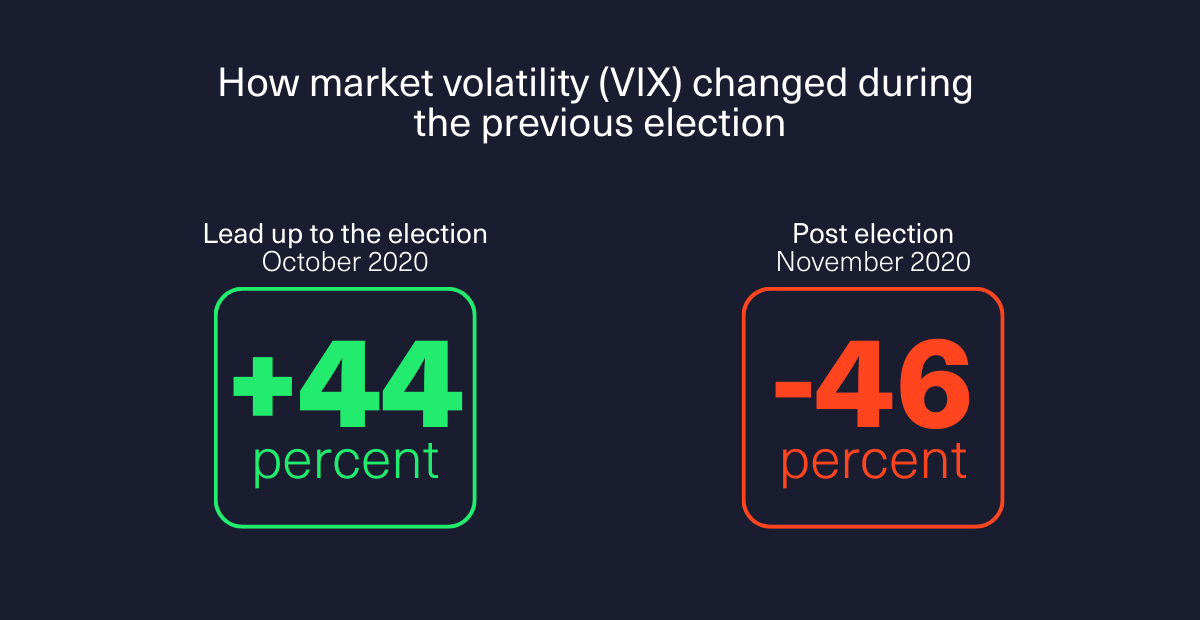

Volatility trading: Immediately before the election is often marked by increased market volatility. Traders can capitalise on these sharp moves for US stocks and the indices that track them. But you need to act fast! As quickly as volatility comes in, it disappears in the weeks following the election, as shown by the Volatility Index that tracks the S&P 500 (US500).

The infographic below shows the VIX relative % change during the last US election, drilling down into October, the month before the election, and November, the month of the election.

Historical performance of US stocks in the most recent election years

2020 – Joe Biden (Democrat) vs Donald Trump (Republican)

The stock market was highly volatile leading up to the election, which could be attributed to high levels of uncertainty surrounding the outcome and the ongoing COVID-19 pandemic. However, after Joe Biden was declared the winner, the market rallied. The S&P 500 and NASDAQ hit record highs in the weeks following the election, fuelled by expectations of extra fiscal stimulus, a stable trade policy, and progress on COVID-19 vaccines.

2016 – Donald Trump (Republican) vs Hillary Clinton (Democrat)

Donald Trump’s unexpected victory initially caused a sharp market drop, but quickly reversed, leading to a rally as investors responded positively to the prospects of tax cuts, deregulation, and increased infrastructure spending. The Dow Jones Industrial Average surged over 1,000 points in the days after the election, reflecting optimism about Trump’s pro-business policies.

2012 – Barack Obama (Democrat) vs Mitt Romney (Republican)

The re-election of Barack Obama led to mixed reactions in the stock market. While the S&P 500 initially dropped due to concerns about the impending fiscal cliff and potential tax increases, the market eventually stabilised as investors shifted their focus to corporate earnings and economic data. The market ended the year with moderate gains, despite the election-related uncertainty.

The table below highlights the performance of the various indices for the last three election years.

The stock market will generally experience increased volatility in the run-up to the election and can either rally or decline sharply depending on which candidate wins the presidency and the perceived impact of that result.

-

USD forex pairs

USD pairs in the forex market are particularly sensitive to US elections, as US monetary policy, trade policies, and fiscal decisions all have an impact globally.

During election periods, traders will be closely monitoring major USD currency pairs such as EUR/USD, GBP/USD, USD/JPY, and USD/CHF, as they can experience significant fluctuations based on both the anticipated and actual election outcomes.

The US dollar plays a central role in the global financial system, and its value can be influenced by election-related factors such as expected changes in interest rates, economic growth prospects, and geopolitical stability. Depending on the election results, the US dollar may strengthen or weaken, which has a knock-on effect on commodity markets, global trade, and investment flows.

Trade strategies for forex during US elections

Safe-haven currencies: In times of uncertainty, traders often turn to currencies like the Japanese yen (JPY) and Swiss franc (CHF), which are considered safe havens. These currencies usually appreciate when investors are risk-averse, making them attractive during periods of potential political instability or economic uncertainty brought about by elections.

For example, if the election results are contested, or lead to concerns about future US economic policies, the USD/JPY pair might see the yen strengthen against the dollar.

Interest rate expectations: The forex market is extremely sensitive to interest rate differentials between countries. Election outcomes can shift expectations about future US interest rates, influencing the value of the dollar.

If the winning candidate is expected to pursue aggressive fiscal stimulus, it could lead to higher inflation expectations and, consequently, higher interest rates, strengthening the dollar. On the other side of the coin, a candidate with a more contractionary stance might lead to expectations of lower rates, weakening the dollar.

Historical performance of US dollar in the most recent election years

2020 – Joe Biden (Democrat) vs Donald Trump (Republican)

The US dollar experienced volatility during the election, initially weakening as uncertainty loomed. However, following Biden's victory, the dollar saw some stabilisation, although it faced downward pressure due to expectations of continued low-interest rates and expansive fiscal policy.

2016 – Donald Trump (Republican) vs Hillary Clinton (Democrat)

The US dollar initially weakened against major currencies like the euro and yen as the election results created uncertainty. However, it quickly rebounded as markets anticipated pro-growth policies from the Trump administration, leading to a stronger dollar.

2012 – Barack Obama (Democrat) vs Mitt Romney (Republican)

Leading up to Barack Obama’s re-election, the dollar remained relatively stable, but post-election, it fluctuated due to concerns about the potential of a fiscal cliff and the future monetary policy.

The table below shows the changes in US dollar during each presidency.

-

Commodities market

Commodities such as gold, crude oil, and agricultural products are also sensitive to US election outcomes. The prices of these commodities can fluctuate based on anticipated changes in US policies, including those related to energy production, environmental regulations, and trade agreements.

Commodities are often seen as a hedge against economic uncertainty and inflation, both of which can be influenced by election results. Additionally, US policies on trade, energy, and the environment can directly impact supply and demand dynamics for key commodities, leading to significant price movements.

For example, a candidate with a strong focus on renewable energy might negatively impact oil prices while boosting demand for metals used in clean energy technologies.

Trade strategies for commodities during US elections

Gold as a safe haven: Gold is a traditional safe-haven asset, and its price often rises during periods of political and economic uncertainty. In the lead-up to and following a US election, if the outcome is uncertain or likely to lead to economic instability, gold prices might increase as investors seek a store of value, presenting opportunities for traders to go long on gold.

Energy policy impact: Crude oil prices are highly sensitive to US energy policies, which can change significantly depending on the election results. A candidate who supports increased drilling and reduced environmental regulations could lead to higher oil supply and potentially lower prices. However, a candidate focused on reducing carbon emissions and promoting renewable energy could restrict oil production and support higher prices. Traders can stay informed on candidates’ views on energy and trade according to the most probable outcome.

Industrial commodities: Commodities like copper, often seen as a barometer of global economic health, can be influenced by election outcomes, particularly if the winning candidate plans significant spending on infrastructure. This stance could boost demand for industrial metals and drive prices up. Traders have an opportunity to take speculative positions in copper and capitalise on this trend.

Historical performance of commodities in the most recent election years

2020 – Joe Biden (Democrat) vs Donald Trump (Republican)

Gold prices surged during the 2020 election as investors sought a safe haven amid uncertainty and fears of prolonged vote counting. However, as the election outcome became clearer and expectations of a stable administration grew, gold prices stabilised. Crude oil also experienced volatility, initially dipping due to concerns over demand during the pandemic, but later recovering as hopes for economic recovery under the new administration grew. Expectations of a green energy agenda under Biden also influenced energy market dynamics.

2016 – Donald Trump (Republican) vs Hillary Clinton (Democrat)

Gold prices spiked on election night as Trump’s victory became apparent, reflecting investor anxiety about the unexpected result. However, as the market digested the potential for economic growth under a Trump administration, gold prices declined, and stocks rallied. Crude oil prices also experienced volatility, reflecting uncertainty about US energy policy under the new administration.

2012 – Barack Obama (Democrat) vs Mitt Romney (Republican)

Leading up to Obama’s re-election, gold and silver saw moderate gains as investors hedged against potential economic uncertainty. After the election, gold prices remained relatively stable but faced downward pressure later in the year due to a stronger dollar and the resolution of some fiscal concerns. Oil prices fluctuated as well, reflecting ongoing concerns about global demand and US energy policy.

In general, gold, and other safe-haven commodities, tend to rise during periods of election-related uncertainty, while oil prices are more directly impacted by the expected energy policies of the potential incoming President.

Alternative markets and hedging opportunities

In addition to US stocks, USD currency pairs, and commodities, alternative markets like global stocks can also provide trading opportunities during elections. International markets are often influenced by US election outcomes, particularly in regions with strong economic ties to the US. For example, emerging markets may react to changes in US trade policy or sentiment around global risk, resulting in potential opportunities for traders.

Cryptocurrency has also come under the spotlight during the current election campaign, thanks to the apparent pivot in support by Republican candidate, Donald Trump. During his Presidency, Trump is known to have labelled cryptocurrency as “a scam”. These days, Trump claims to be “the first major party nominee in American history to accept donations in Bitcoin and crypto,” alleging he’s raised more than $25 million from cryptocurrency donations in the last two months.

Recently, while addressing the Bitcoin Conference in Nashville, Tennessee, Trump stated that if he returned to the White House, he vowed, “United States will be the crypto capital of the planet and the Bitcoin superpower of the world”. He went on to make promises of wide deregulation of the industry with new regulations designed and written by “people who love your industry, not hate your industry.”

On the other side of the fence, while Kamala Harris has not made any public proclamation regarding her view on cryptocurrency, the Democratic camp is not known to be fully supportive of the rise of digital assets.

Hedging strategies can help manage the risks associated with election-related market movements. These instruments provide protection against adverse price movements or allow traders to profit from increased market volatility.

The bottom line

US elections are crucial political events that can create significant volatility across financial markets. By understanding the historical performance of markets like US stocks, USD-based forex, and commodities, traders can better position themselves to navigate these periods of uncertainty and turn volatility into opportunity.

While past performance does not guarantee future results, these historical patterns offer valuable insights into potential market behaviour. Also, exploring alternative markets and hedging strategies offers further ideas for managing risk and capitalising on opportunities during this critical time.

Volatility is more opportunity

Take advantage with FXTM. Trade US stocks, forex, commodities, and more.

Capital at risk. Meant for educational purposes only.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.