Natural gas trading:

How to trade natural gas

Learn the fundamentals of trading natural gas, including how it works, trading strategies and more.

What is natural gas?

Natural gas is a fossil fuel that’s extracted from the ground. It’s often mistaken for a by-product of crude oil – like gasoline or heating oil – but it’s not. It just exists alongside oil reserves.

Natural gas currently represents around a quarter of the EU's overall energy consumption. About 26% of that gas is used in the power generation sector (including in combined heat and power plants), and around 23% in industry.

Once it’s been extracted, natural gas needs to be treated and processed into other gas or liquid forms to make it suitable for transport across countries. So, while it’s a cheap, naturally occurring energy source, the extraction and treatment process is costly.

Natural gas is one of the cleanest energy supplies due to its low carbon dioxide emissions when burnt. It’s also known for its volatility, making it the second-most popular energy commodity for traders.

How to trade natural gas

There are a few different ways you can trade natural gas.

The most popular are gas spot prices, futures and options, but you can also gain exposure via stocks and ETFs.

With FXTM, you can use CFDs to speculate on natural gas spot prices. Trading CFDs enables you to profit when prices rise or fall – and you don’t have to own the actual gas yourself.

| Live natural gas spot price | ||

|---|---|---|

| Sell | Buy | |

| NatGas | ||

Natural Gas Industry Overview

Natural gas extraction has improved significantly over the last few decades as technology and extraction techniques improve. This means it is easier than ever to respond to changes in demand.

It is likely that natural gas extraction will continue to become even more efficient as the industry advances in years to come.

What impacts the price of gas?

Like almost all financial markets, the price of gas is primarily moved by the relationship between supply and demand. But due to gas’s essential role in the global economy, it can be the subject of drastic price swings depending on whether the market is growing or declining.

Here are a few of the major factors that can impact gas prices:

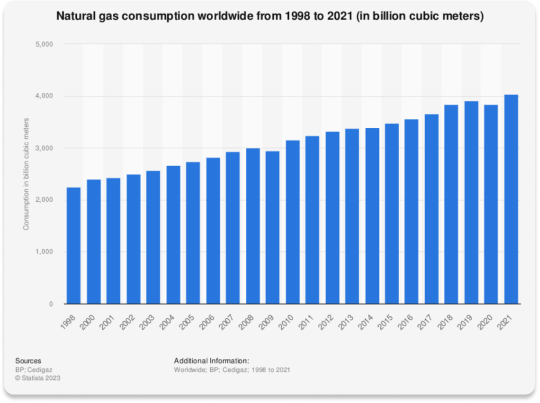

Global demand

The International Energy Agency reports that global natural gas demand will grow slowly up to 2025, as Russia’s war in Ukraine causes supply disruptions and pushes prices higher.

Source: https://www.statista.com/statistics/282717/global-natural-gas-consumption/

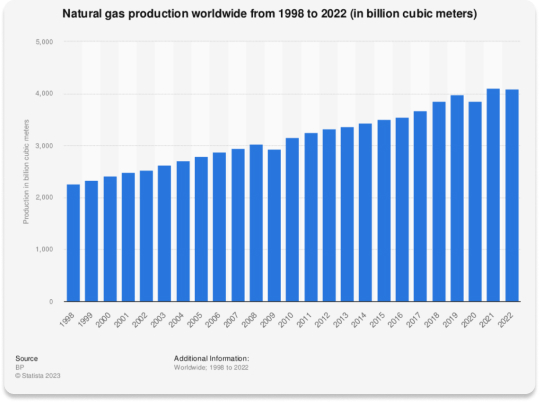

Level of natural gas production

When gas production goes up, prices tend to decrease. This is because when gas is readily available, natural market forces work to reduce prices for consumers. As gas extraction techniques have massively improved over time – including the controversial “fracking” process – making it much quicker and easier to produce, it's generally worked to reduce gas prices.

Source: https://www.statista.com/statistics/265344/total-global-natural-gas-production-since-1998/

Become a better trader

Whether you’re new to trading or have years of experience, level up your skills with our free educational resources.

Popular gas trading strategies

Before you start trading gas, you’ll want to make sure you have a clear trading strategy to help support your decisions.

Here are a few popular strategies for trading gas as a commodity

Day Trading

Day traders aim to make small profits on many trades throughout the day, allowing them to capitalise on multiple opportunities in a single trading session.

Due to its high volatility, natural gas trading is an attractive option for day traders – with the potential to make profit in a short time window.

Day trading is generally better suited to people who have plenty of time to commit. Successful day traders must keep their finger on the pulse of the market and pay close attention to anything that could affect gas prices.

Range trading

Once the levels of support and resistance have been identified, traders will attempt to buy at the support level and sell at the resistance level.

Range trading is particularly effective in volatile markets (like gas) where there isn't a clear long-term trend in either direction.

Gas prices can fluctuate significantly within a range, providing traders with ample opportunities to buy and sell at the support and resistance levels. By using range trading, traders can take advantage of these fluctuations to generate profits.

Breakout trading

Breakout trading is a popular trading strategy used by traders to capitalize on sudden price movements in volatile markets. The idea behind breakout trading is to enter a position as soon as prices ‘break out’ of their current range. This is based on the belief that a breakout is a strong indicator that the price will continue moving further in that direction.

A breakout strategy can be used in both rising and falling markets, making it a popular choice for volatile markets like gas.

Swing trading

FREQUENTLY ASKED QUESTIONS

You can also gain exposure to natural gas by buying natural gas stocks. This would give you part ownership of companies that play a key role in the production, transportation or exportation of natural gas, or are closely involved in the sector.

You might be interest in..

Put knowledge into action

Now you know how gas trading works, put your new knowledge to the test. Practise trading on our risk-free demo or tackle the markets for real with a live account.