ABC Patterns in Trading: A Strategy Guide

Mastering ABC patterns lets you recognise and capitalise on market movements as they happen. This beginner's guide helps you to understand what ABC patterns are and how to use them as part of your trading strategy.

Key takeaways

ABC patterns provide vital insights into market direction and potential reversals

Proper identification of ABC patterns can lead to high-probability trading setups

Beginners can master ABC patterns by understanding the steps and reviewing price history

Jump to your chapter of interest

How to Trade Forex Using ABC Patterns

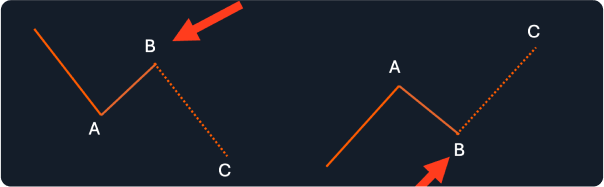

Trading with ABC patterns involves identifying the three pivotal points: A, B, and C:

- A new price move starts

- The price retraces without surpassing point A's starting level

- The retracement from B end and the initial trend from A to B resumes

A new trend begins...

Point A marks the inception of a significant price movement, setting the stage for a potential high-yield trade - it's where discerning traders keenly focus their attention to anticipate future market trends.

The price reverses (but doesn’t cross ‘A’...)

B represents the market's natural response to the initial price surge at A, where the trend takes a momentary break. It 'retraces' a bit without erasing the gains made initially. Retracement in trading is when the market moves against the trend, but not for long. It usually happens after rapid price rises or falls.

Think of B as a test of the market's commitment to the new direction - a necessary consolidation that adds credibility to the emerging trend. This reflective phase is when smart traders gain insights and confirm the trend's foundation's strength.

One key takeaway from B is that it doesn't surpass the starting level of A, which solidifies its role as a reliable signal of sustained momentum, rather than a collapse. Understanding the nuances of B not only hones your analytical skills but also puts you in control of decision-making amidst the ever-changing market dynamics.

The trend resumes

Finally, at C, the market narrative takes a decisive turn. Here, the retracement that commenced at B concludes, and the price movement from A to B resumes with renewed vigour.

This is a tell-tale sign for the astute trader, indicating that the time is ripe to capitalise on the resilience of the market's original impetus.

Think of C as the catalyst that sparks action, opening up opportunities for those who can see it as a sign that the market is ready to follow a trend. By carefully evaluating C, traders can make better decisions and position themselves to potentially benefit from a trend resurgence.

Understanding the dynamics at C will sharpen your trading skills, helping you navigate the markets with confidence and finesse.

To effectively use these patterns, you need to carefully observe the price swings and identify the key points with precision. It's also a good idea to use technical indicators for confirmation to make your observations more reliable.

Another thing to consider is practicing on historical data, as it helps improve pattern recognition. And don't forget to set strict stop-loss orders to protect your capital from unexpected market movements.

For the best trading execution, wait for the pattern to fully form. Entering trades too early at point B can sometimes make you misinterpret market corrections as ABC pattern formations.

Examples of ABC Pattern Trades

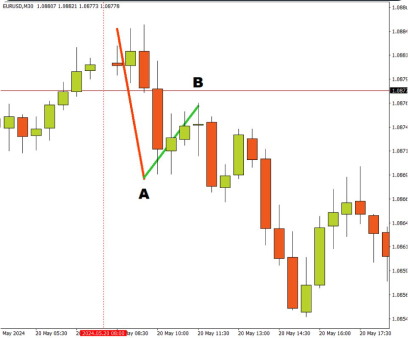

Success in ABC pattern trades is often through experience and comprehensive market knowledge. For instance, studying a previous EUR/USD trade might reveal a pronounced ABC pattern during a news release, when the market retested a significant level at point B before continuing the trend to C, yielding a profitable opportunity for sharp traders.

Here's quick example of what this might look like in the real world:

Choosing the Right ABC Trading Strategy

Let's take a look at some common strategies used in trading ABC patterns:

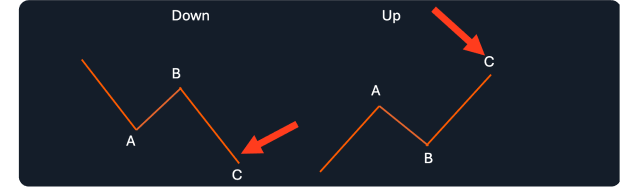

The bullish ABC pattern strategy:

This one works well in uptrends. You can buy at point C and aim for higher highs. Remember to control your risk by placing stop-loss orders below point A.

The bearish ABC pattern strategy:

This is suitable for downtrends. Sell at point C and aim for lower lows. Place stop-loss orders above point.

The breakout ABC pattern strategy:

This is effective when you expect the price to break out of a resistance or support level. Wait for confirmation at point C before entering your trade in the direction of the breakout.

The range-bound ABC pattern strategy:

If you're dealing with a range-bound market, you can identify both bullish and bearish patterns to trade within the established range. For instance, aim for short positions near point B and long positions near point A.

The combined ABC pattern strategy:

This involves combining different technical indicators like moving averages or stochastic indicators to confirm the ABC pattern. This helps reduce the risk of false signals and increase the probability of successful trades. Remember, being aware of these strategies can help you navigate the forex markets more effectively!

The bottom line

ABC patterns can be a game-changer for forex traders, whether you're just starting out or you're at an intermediate level. When used wisely, they become a powerful tool in your trading arsenal. Mastering ABC pattern trades requires not only knowledge and experience but also a strategic approach that combines confidence with practicality.

FREQUENTLY ASKED QUESTIONS

No chart pattern is 100% reliable, and the ABC pattern is no exception. It's essential to use it in conjunction with other technical analysis tools and indicators to increase its reliability.