Daily Market Analysis and Forex News

How to trade silver: A comprehensive guide

In the world of precious metals trading, silver holds a unique allure for both seasoned and beginner traders. Its historical significance, diverse industrial uses, and potential for high returns can make it an attractive asset.

Whether you're looking to hedge against inflation or diversify your portfolio, trading silver can be a rewarding venture. This comprehensive guide will walk you through everything you need to know about trading silver.

Contents

- What is Silver Trading?

- Why Trade Silver?

- Silver Trading Strategies

- How to Trade Silver Effectively

- Understanding Silver Futures

- Investing in Silver ETFs and Stocks

- The Gold-Silver Ratio

- Silver Commodity Trading and Derivatives

- The Bottom Line

What is Silver Trading?

The Basics of Silver Trading

Silver trading involves buying and selling silver in various forms to capitalise on its price movements.

Unlike gold, silver has a wide array of industrial applications, which adds to its demand dynamics. You can trade silver through physical bullion, futures contracts, ETFs, CFDs, and more.

Different Forms of Silver Trading

Silver can be traded via a range of financial instruments, each offering unique advantages and risks. Here are some of the most common:

1. Silver Futures:

Silver futures allow traders to speculate on the future price of silver with a fixed end date. These contracts are standardised agreements to buy or sell a specific quantity of silver at a predetermined price on a future date.

Futures offer high leverage but come with significant risk.

2. Silver ETFs:

Exchange-Traded Funds (ETFs) offer a way to invest in silver without having to deal with physical storage. They come in two types:

-

Physical Silver ETFs: These ETFs hold physical silver bullion.

-

Silver Mining ETFs: These ETFs invest in stocks of companies involved in silver mining.

3. Silver CFDs:

Contracts for Difference (CFDs) allow traders to speculate on silver price movements without owning the underlying asset. CFDs offer high leverage, but traders should be wary of the risks involved.

4. Silver Stocks:

Investing in silver mining stocks provides exposure to the silver market. These stocks can be affected by both the price of silver and the operational performance of the mining companies.

5. Silver Spot Trading:

Spot trading involves buying and selling physical silver for immediate delivery, rather than a date in the future (like with silver futures).

It reflects the current market price of silver and is commonly used by traders looking to make quick transactions.

Why Trade Silver?

Benefits of Trading Silver

Trading silver offers a range of benefits, making it a compelling option for traders:

Hedge Against Inflation:

Historically, silver has served as a reliable hedge against inflation, offering a safeguard for purchasing power over time. This is not only because of its ability to store wealth, but its wide use in industrial applications. Fiat currencies (like the US dollar or Euro) can lose value over time due to inflationary pressures.

Safe Haven Asset:

Silver is seen as a safe-haven commodity due to its ability to maintain value during times of uncertainty. However, it remains much volatile than gold due to its lower value and greater sensitivity to economic changes.

Historically, silver has demonstrated a tendency to rise in value when stock markets decline or when inflation fears loom large.

Affordability:

Compared to gold, silver is significantly more affordable, which makes it accessible to a broader range of traders. The affordability can be measured using the gold-silver ratio which assess the proportional relationship between the two precious metals.

For example, if gold trades at $2500 per ounce and silver at $25, traders refer to a gold-silver ratio of 100:1. This means you’d need 100 ounces of silver to buy one ounce of gold.

This affordability opens up opportunities for those who may not have the capital to invest in gold, allowing them to diversify their portfolios with precious metals.

Industrial Demand:

Silver plays a crucial role in various sectors such as electronics, solar panels, and medical devices.

In electronics, silver is an essential component due to its excellent conductivity, making it ideal for circuit boards, connectors, and other critical components. The rise of smart technologies and the Internet of Things (IoT) has further increased the demand for silver in this field.

In the renewable energy sector, silver is a key player in solar panel production. It enhances the efficiency of solar cells, contributing to the growing shift towards sustainable energy solutions. As the global push for renewable energy continues, the reliance on silver in solar technology is expected to rise, driving demand even higher.

Additionally, silver's antimicrobial properties make it valuable in the medical field. It is used in wound dressings, coatings for medical devices, and various healthcare applications.

Although this diverse range of uses bolsters silver's demand, it also makes it more volatile than gold and sensitive to various measures of manufacturing data.

Diverse Trading Instruments:

From futures contracts to exchange-traded funds (ETFs), there are numerous ways to trade silver, each catering to various risk appetites and investment strategies.

The diversity in silver trading options enables traders to tailor their strategies based on their financial goals and market outlook.

Risks of Trading Silver

While trading silver has its rewards, it's essential to understand the associated risks:

Price Volatility:

Silver prices can be highly volatile, influenced by various factors such as industrial demand, investment demand, geopolitical events, and changes in economic indicators. This volatility can lead to substantial gains or losses for traders.

For instance, during times of economic uncertainty, silver often sees increased demand as a safe-haven asset, driving prices up significantly. Conversely, when the market stabilises or interest rates rise, silver prices may decline sharply.

Understanding these dynamics is crucial for anyone looking to invest in silver, as timing and market awareness can greatly impact financial outcomes.

Leverage Risks:

Leverage can significantly enhance potential profits in trading by allowing traders to control a larger position with a smaller amount of capital. This means that even a small movement in the market can lead to substantial gains.

However, it is crucial to understand that while leveraging can increase profits, it also carries a heightened risk of amplifying losses. In futures and CFD trading, where leverage is commonly used, a minor unfavourable price shift can result in losses that exceed the initial investment.

Therefore, traders must exercise caution, implement effective risk management strategies, and fully comprehend the implications of using leverage to avoid significant financial setbacks.

Market Manipulation:

The silver market is particularly susceptible to manipulation due to its relatively small size compared to other commodities like gold or oil. A handful of large players can significantly influence silver prices through their trading activities. This manipulation can take various forms, such as coordinated buying or selling to create artificial price movements or spreading misinformation to sway market sentiment.

Economic and Industrial Factors:

Economic downturns and fluctuations in industrial demand can significantly influence silver prices. During periods of economic uncertainty, investors often seek safe-haven assets, leading to increased demand for silver as a store of value.

Conversely, when the economy is thriving, industrial demand for silver in sectors like electronics, solar energy, and automotive production can drive prices higher. Additionally, changes in global supply chains, mining outputs, and geopolitical events can also contribute to volatility in silver prices. Understanding these dynamics is crucial for investors and traders looking to navigate the silver market effectively.

Liquidity Concerns:

Not all silver trading instruments are created equal when it comes to liquidity. While some instruments, like popular silver ETFs or futures contracts, tend to have high trading volumes and can be easily bought or sold, others may experience lower liquidity.

This lower liquidity can result in execution issues, such as wider bid-ask spreads or difficulty in executing trades at desired prices. Traders relying on less liquid instruments might face challenges, particularly during volatile market conditions, where the ability to quickly enter or exit a position becomes crucial.

Storage and Insurance Costs:

Investing in physical silver involves additional considerations beyond the initial purchase price. Secure storage is essential to protect your investment from theft or damage, which often means renting a safe deposit box at a bank or purchasing a home safe, both of which come with their own costs.

Additionally, insuring your silver can provide peace of mind, but it also adds to the overall expense of investing in this precious metal. It's important for investors to factor in these costs when calculating the potential return on their investment, as they can significantly impact the overall profitability of holding physical silver.

Silver Trading Strategies

Trend Trading Silver

Trend trading is a strategy that focuses on identifying and capitalising on the prevailing market trends, whether they are upward, downward, or sideways.

Traders utilise a variety of technical analysis tools, including moving averages, trendlines, and momentum indicators, to detect shifts in market dynamics and pinpoint significant trends in silver prices.

Moving averages help traders smooth out price data to identify the direction of the trend over a specific period. A simple moving average (SMA) can indicate a general trend, while exponential moving averages (EMA) may provide quicker signals for entry and exit points.

Trendlines, drawn on price charts, visually represent the direction and speed of price movements, allowing traders to see where a trend may be gaining or losing momentum.

By aligning their trades with these established trends, traders seek to maximise their potential profits. This approach often involves entering positions in the direction of the trend, using strategies such as buying on pullbacks in an uptrend or selling on rallies in a downtrend. Risk management plays a critical role in trend trading, as traders often set stop-loss orders to protect their capital in case the market moves against them.

Overall, trend trading requires a keen understanding of market behaviour, discipline, and the ability to adapt to changing conditions, making it a popular choice among both novice and experienced traders seeking to profit from market movements.

Range Trading Silver

Range trading is a popular strategy among traders, particularly in markets where silver prices exhibit relative stability. In this approach, traders focus on identifying key support and resistance levels, which are fundamental to understanding market dynamics.

The support level is the price point where demand is strong enough to prevent the price from falling further, while the resistance level is where selling pressure is sufficient to stop the price from rising.

When traders spot silver prices nearing the support level, they typically enter a buying position, anticipating a price bounce as demand increases. Conversely, when prices approach the resistance level, they sell, expecting that the upward momentum will falter and the price will decline.

This strategy is especially effective when silver prices fluctuate within a defined range, as it allows traders to capitalise on predictable price movements. Successful range traders often employ technical analysis tools, such as moving averages and oscillators, to refine their entry and exit points and enhance their decision-making process.

By effectively managing risk and adhering to their trading plan, traders can achieve consistent returns through range trading, making it an attractive option for those looking to navigate the silver market.

How to Trade Silver Effectively

To trade silver effectively, it is essential to develop a sound trading strategy, understand market dynamics, and use the right tools and platforms. First, investing in research and analysis will help you make informed decisions. Stay updated on global economic trends, geopolitical events, and industry developments that can influence silver prices.

Moreover, choosing the right brokerage is crucial. Select a platform that offers comprehensive trading tools, real-time data, and expert insights to help you analyse the market and execute trades efficiently.

With FXTM, you have access to advanced trading instruments and platforms, enabling you to navigate the silver market with confidence.

Also, risk management plays a vital role in successful silver trading. Use techniques like setting stop-loss orders and diversifying your portfolio to minimise potential losses while maximising opportunities for profit. By combining thorough research, strategic planning, and effective risk management, you can enhance your chances of success in trading silver.

Understanding Silver Futures

What Are Silver Futures?

Silver futures are standardised contracts that oblige the buyer to purchase, and the seller to deliver, a specific amount of silver at a predetermined price on a set date in the future.

These contracts are traded on exchanges like the COMEX, providing a regulated environment where participants can hedge or speculate on the price movements of silver.

Trading silver futures allows market participants to lock in prices and hedge against price volatility, making them a valuable tool for both producers and consumers of silver.

Silver Futures Contract Size

The standard contract size for silver futures is 5,000 troy ounces of silver.

This large contract size makes silver futures suitable for institutional investors, large traders, and commercial entities involved in the silver market. However, there are also smaller contracts available, such as mini and micro silver futures, which cater to individual investors and smaller traders.

Silver Futures Tick Value

Silver futures have a tick value, which represents the minimum price movement of the contract. For example, for a standard 5,000-ounce silver futures contract, a tick is typically $0.001 per ounce, translating to a $5 move per contract.

Being aware of the tick value helps traders understand the potential profit or loss for each price movement, allowing them to manage their trades more precisely.

Investing in Silver ETFs and Stocks

Investing in silver ETFs and stocks can be an excellent way to gain exposure to the silver market without dealing with physical bullion.

Silver ETFs

Silver ETFs come in two main types:

Physical Silver ETFs:

These ETFs hold physical silver bullion, providing direct exposure to silver prices.

Silver Mining ETFs:

These ETFs invest in stocks of companies involved in silver mining, offering indirect exposure to silver prices and the performance of mining companies.

Differences Between ETFs and Stocks

When deciding between ETFs and stocks, consider the following differences:

Diversification:

ETFs, or exchange-traded funds, provide a strategic approach to investing by holding a diverse range of assets within a single fund. This diversification helps mitigate risk, as it spreads investments across various sectors, industries, or geographic regions, rather than concentrating funds in individual stocks.

By investing in an ETF, you can gain exposure to multiple companies and asset classes, which can cushion your portfolio against volatility.

Additionally, ETFs often come with lower fees compared to mutual funds, making them a cost-effective option for investors looking to build a balanced and resilient investment strategy.

Liquidity:

ETFs trade on stock exchanges like individual stocks, which allows investors to buy and sell them throughout the trading day. However, the liquidity of an ETF is often influenced by the liquidity of its underlying assets.

For instance, if an ETF tracks a highly liquid index or comprises stocks from large-cap companies, it generally exhibits better liquidity characteristics. Conversely, if the ETF includes less commonly traded stocks or is focused on niche sectors, its liquidity may be lower.

In contrast, while individual stocks can also be highly liquid—especially those from large, well-established companies—stocks from smaller firms may not trade as frequently, leading to wider bid-ask spreads and potentially greater price volatility.

Overall, while both ETFs and stocks are liquid, the nature of an ETF can provide more stability and ease in trading, making them a preferred choice for many investors seeking efficient market entry and exit points.

Risk and Return:

Stocks can provide the potential for higher returns due to their ability to appreciate significantly in value over time. However, this potential for growth is coupled with increased risk, as individual stocks can be highly volatile and susceptible to market fluctuations.

Unlike diversified ETFs, which spread investments across a wide range of assets, thereby reducing risk, investing in individual stocks can expose investors to the performance of a single company.

As a result, while stocks may offer the allure of substantial profits, it is essential for traders to consider their risk tolerance and investment strategy when choosing between stocks and diversified ETFs.

Management:

ETFs are generally passively managed investment vehicles that aim to replicate the performance of a specific index or sector. This means that they are designed to follow a predetermined strategy, requiring minimal intervention from fund managers. As a result, ETFs often have lower management fees and provide investors with instant diversification across various assets.

On the other hand, investing in individual stocks typically requires a more active management approach. Traders must conduct thorough research and analysis to evaluate the performance and potential of each stock, keeping a close eye on market trends, company news, and economic indicators.

This active management can lead to higher potential returns, but it also comes with increased risk and the need for constant attention and strategy adjustments.

The Gold-Silver Ratio

The gold-silver ratio is a valuable tool for traders. It represents the amount of silver it takes to purchase one ounce of gold. Traders use this ratio to analyse relative value and make trading decisions. When the ratio is high, silver is considered undervalued relative to gold, and vice versa.

How to Use the Gold-Silver Ratio in Trading

Identify Extremes

By monitoring the gold-silver ratio, traders can identify extreme levels that suggest silver is either overvalued or undervalued relative to gold. This can inform buy or sell decisions.

Hedging

The gold-silver ratio can also be used for hedging purposes.

Let’s say the ratio is trading around 100 (well above average levels seen in the past few decades). This could signal that the average value of gold is relatively expensive compared to silver.

Traders expecting the ratio to decline back to average levels may take a long position in silver while selling the equivalent amount of gold and vice versa. This can result in potential profits even if the price of both metals moves significantly.

Silver Commodity Trading and Derivatives

Silver commodity trading and derivatives provide advanced trading opportunities and leverage.

Silver Contracts and Their Uses

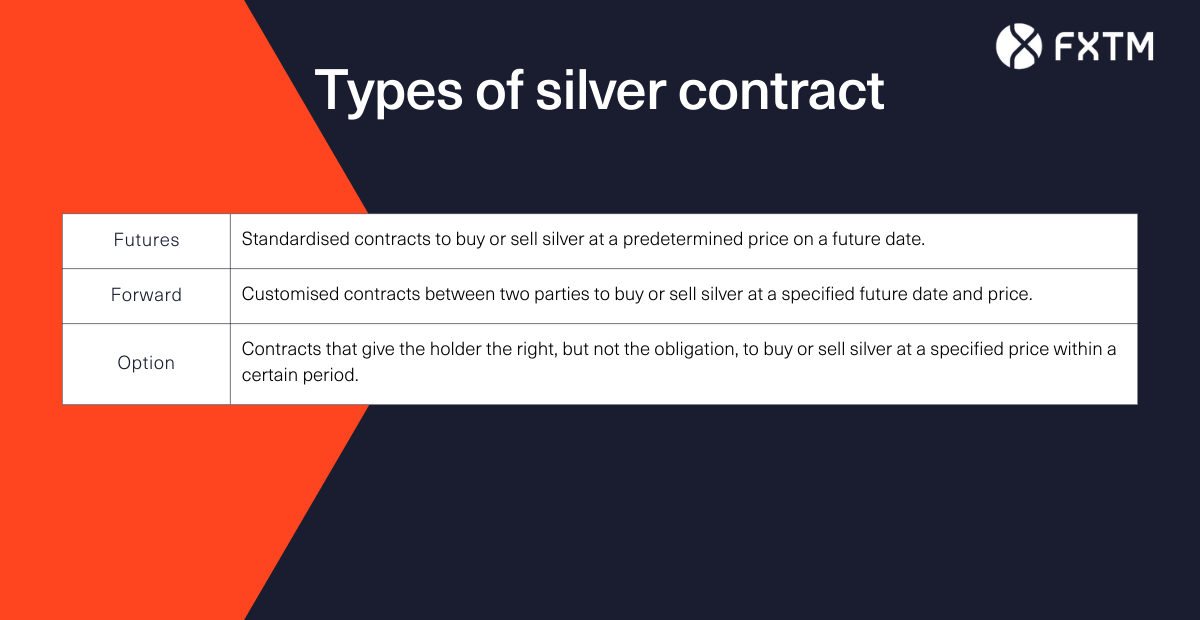

Silver contracts come in various forms, each serving different purposes:

Futures Contracts:

Standardised contracts to buy or sell silver at a predetermined price on a future date.

Forward Contracts:

Customised contracts between two parties to buy or sell silver at a specified future date and price.

Options Contracts:

Contracts that give the holder the right, but not the obligation, to buy or sell silver at a specified price within a certain period.

Trading Silver Derivatives

Silver derivatives offer advantages to traders:

Leverage:

Derivatives are financial instruments that derive their value from an underlying asset, such as stocks, bonds, commodities, or currencies. They play a crucial role in the trading world by allowing traders to control large positions with relatively small capital investment.

This leverage can significantly amplify potential returns, as traders can participate in larger market movements without needing to commit a substantial amount of their own funds upfront.

However, it's important to note that while the potential for higher returns exists, so does the risk; losses can also be magnified in the same way. Thus, understanding the intricacies of derivatives and managing risk effectively are essential for traders looking to harness their power.

Liquidity:

High liquidity in silver derivatives markets allows for quick and efficient trade execution, which is crucial for both individual investors and large institutions.

This liquidity means that traders can buy and sell silver derivatives without significant delays or price slippage, ensuring that they can capitalise on market opportunities as they arise. Additionally, high liquidity often leads to tighter bid-ask spreads, reducing trading costs and making it more attractive for participants to engage in these markets.

The presence of a diverse range of market players also contributes to this liquidity, as it fosters a competitive environment that further enhances the efficiency of trade execution.

Flexibility:

Derivatives offer significant flexibility in trading strategies, making them invaluable tools for traders. They enable hedging, which allows market participants to protect their investments against adverse price movements. By using derivatives, such as options and futures, traders can lock in prices, reducing the risk associated with fluctuating markets.

Furthermore, derivatives facilitate speculation, providing opportunities to profit from price changes in underlying assets without needing to own them directly. This aspect attracts traders looking to capitalise on market trends and movements.

Additionally, derivatives play a crucial role in risk management. They allow institutions and individuals to transfer risk to other parties willing to accept it, thereby stabilising financial markets. This capability is particularly important in volatile environments, where effective risk management can protect portfolios and enhance overall investment strategies.

Trade Silver with a Global, Award-Winning Broker

At FXTM, we offer a range of trading instruments and platforms to help you trade silver effectively. With our advanced tools and expert insights, you can make informed trading decisions and maximise your returns.

The Bottom Line

In conclusion, trading silver presents a wealth of opportunities for both experienced and new traders alike.

By understanding the gold-silver ratio, utilising various silver contracts and derivatives, and leveraging tools provided by reputable brokers like FXTM, individuals can navigate the complexities of the silver market successfully.

With the right strategies and insights, traders can not only manage risks effectively but also capitalise on the dynamic movements in silver prices, fulfilling their investment goals in this precious metal.

FAQs

How do you trade silver futures?

To trade silver futures, open an account with a brokerage that offers futures trading like FXTM. Learn about contract specifications, margin requirements, and trading strategies.

Where can I buy silver at the spot price?

You can buy silver at the spot price from reputable dealers, online marketplaces, and financial institutions that offer precious metals trading. With FXTM, you can trade spot silver.

How can I buy silver stocks?

To buy silver stocks, open an account with a brokerage firm. Research silver mining companies and select stocks that align with your investment goals.

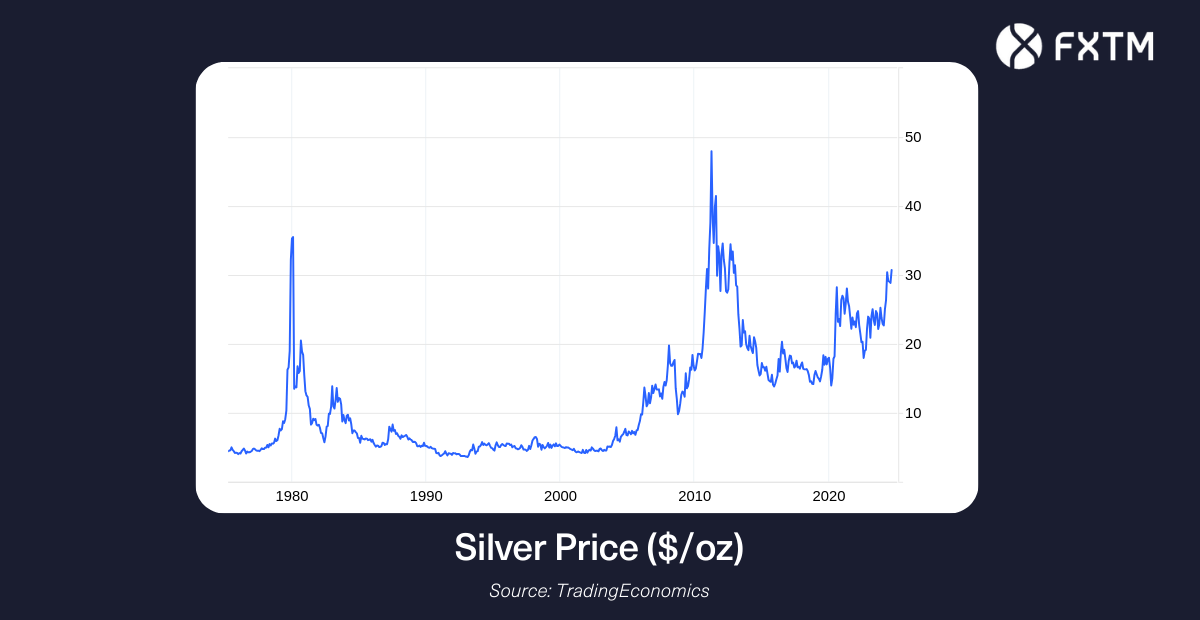

What is the highest price of silver in history?

The highest price of silver in history was $49.45 per ounce in January 1980, driven by market speculation and geopolitical tensions.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.