GUIDE | TRADING BASICS | BEGINNER

Reading Candlestick Trading Charts

Learn how to determine price movements and increase your potential to earn in the markets.

Trading is risky

Introducing Candlestick Charts

Once you start to trade forex instruments, you will notice that professional traders and brokers use a number of diagrams, analysis tools, graphs and stock charts to highlight projections and patterns in day trading.

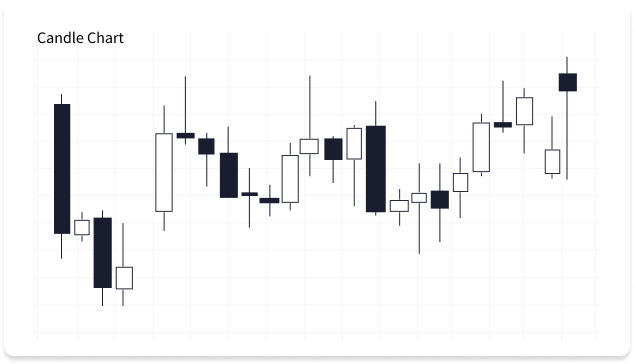

One such tool that is commonly used is a candlestick chart. Candlestick charts are particularly popular in day trading for two reasons: they offer a wide range of trading information and their design makes them easy to read and interpret.

It is important to understand how to read candlestick charts and what the different components of a candle are. If you want to learn how to apply candlestick chart analysis to your trading strategy, this article covers all the basics to help you get there.

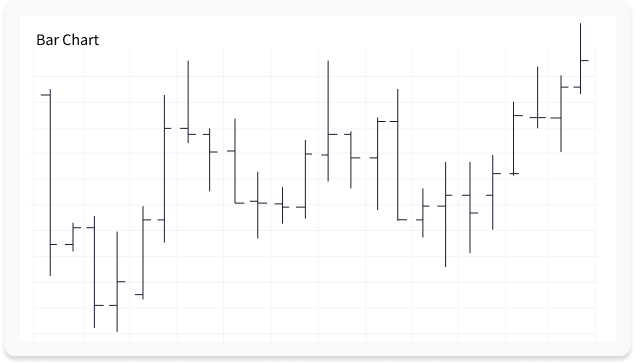

Bar Chart

Bar charts and line charts are two other popular indicators for price analysis in forex trading, but candlestick charts have become more popular over time.

Candlestick charts offer an enjoyable visual perception of price, which is a distinct advantage over bar charts. Bar charts are not as visual as candle charts, and the candle formations or price patterns are not as easy to distinguish as they are in candlestick charts.

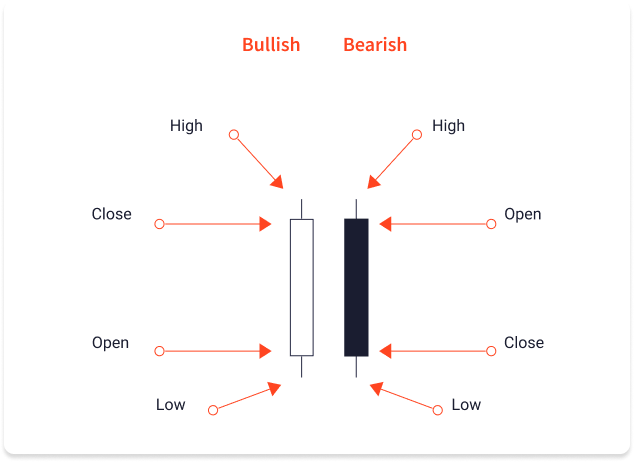

Understanding a candlestick chart’s meaning

Learning how to understand a candlestick chart’s meaning is simple, as there are only four data points displayed. These points are Open, Close, High and Low. They make up the candlestick chart and indicate the open, highest, lowest, and close prices for the time frame the trader has chosen

When you read a candlestick chart, you can determine if a session is bullish or bearish based on the opening and closing prices of the candlesticks.

When the closing price is higher than the opening price, it is called a Bullish Candlestick. If the closing price is lower than the opening price, it is known as a Bearish Candlestick. The upper and lower shadows of the candlestick mark the highest and lowest price during the chosen time period (one minute, 60 minutes, one day etc.)

Candlestick charts are a useful tool to better understand the price action and order flow in the forex market. However, before you can read and explain a candlestick chart, you must understand what it is and become comfortable identifying and using candlesticks patterns.

What is a Candlestick Chart?

A candlestick chart is a technical tool for forex analysis that consists of individual candles on a chart, which indicates price action. Candlestick price action requires forex traders to identify the place where the price opened for a period, where the price closed for a period, and to pinpoint the price highs and lows for a specific period.

A price action analysis is useful as it can give traders an insight into trends and reversals.

For example, groups of candlesticks can form patterns throughout forex charts and diagrams that could indicate reversals or continuation of trends. Candlesticks can also form individual formations, which could indicate buy or sell entries in the market.

The period of each candle typically depends on the time frame chosen by the trader. The most popular time frame is the daily one, where the candle indicates the open, close, and high and low for one single day.

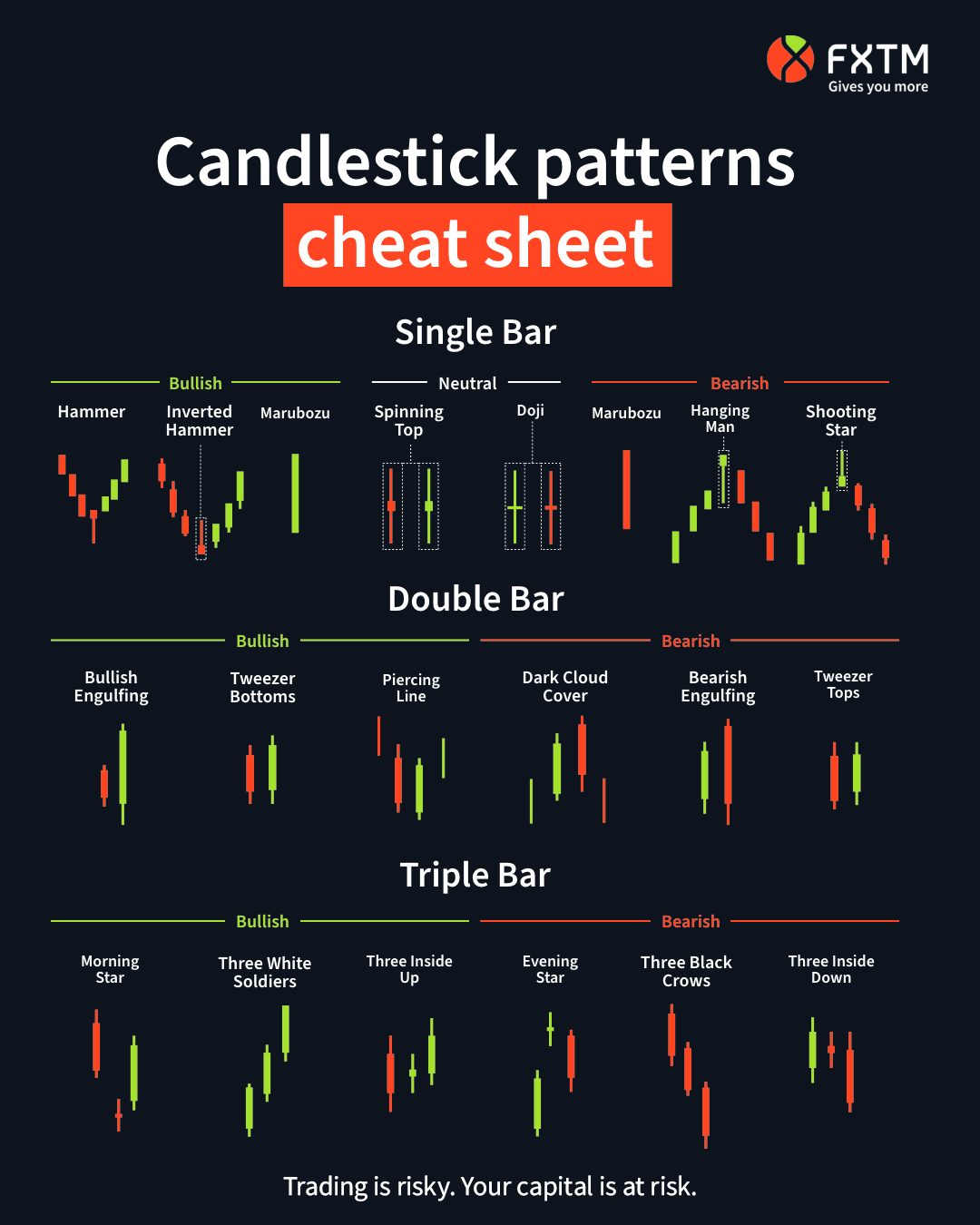

Grab your candlestick patterns cheat sheet.

While you're still familiarising yourself with candlestick patterns, it can be helpful to have a quick reference. Our cheat sheet outlines the most common patterns, categorised by the number of bars and market sentiment - bullish, neutral or bearish.

Japanese Candlesticks: History and basic formations

The very concept of candlestick charts used in forex trading comes from Japanese rice farmers in the 18th century. Candlesticks build patterns were introduced to the Western world by Steve Nison in his popular 1991 book, "Japanese Candlestick Charting Techniques."

In fact, candlestick charts had been used for centuries before the West developed the bar and point-and-figure charts we know and use today. In the 1700s, a Japanese man named Homma noted that in addition to the link between price and the supply and demand of rice, the markets were strongly influenced by the emotions of traders.

Candlesticks started being used to visually represent that emotion, as well as the size of price movements, with different colours. Traders use candlesticks to make trading decisions based on patterns that help forecast the short-term direction of the price.

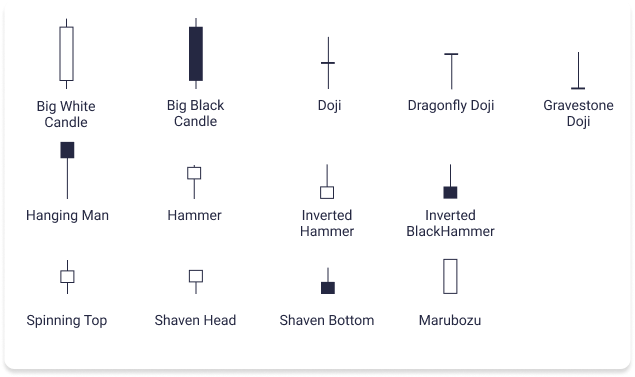

To the left you’ll see some various Japanese candle formations used to determine price direction and momentum, including the Doji, Hammer, Spinning Top, and Marubozu.

Japanese Candlestick Charts

The Japanese Candlestick method of visualising charts is one of, if not the, most popular methods of looking at charts for the modern trader.

Check out our technical analysis video dedicated to Japanese candlestick charts

Ready to turn your knowledge into action?

Open your account or get back into trading right now.

Understand Candlestick Pattern Types

There many different candlestick patterns you can use. However, professional traders may use some of the most popular candlestick patterns that provide information on the three market sentiments: bullishness, bearishness, and a neutral or tentative market condition.

One of the main things to remember when looking at candlestick pattern types is that there is a difference between simple and complex candlestick patterns.

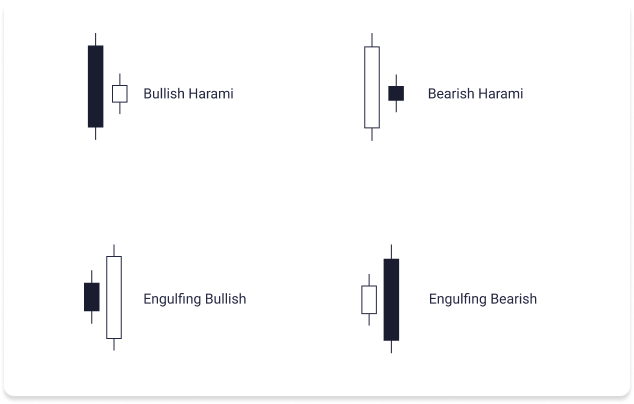

It depends on the number of candlesticks required to form the patterns. A simple candlestick pattern requires a single candlestick, while the more complex candlestick patterns usually require two or more candlesticks to form.

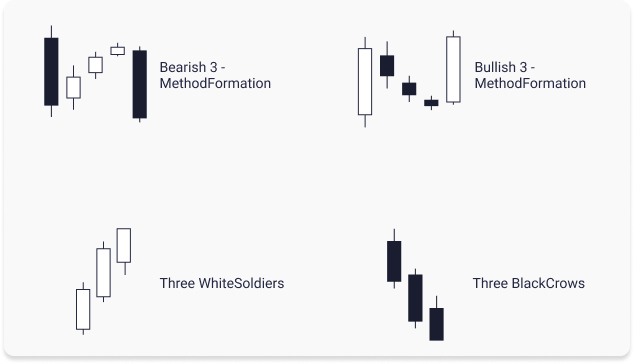

Examples of more complex patterns

There many different candlestick patterns you can use. However, professional traders may use some of the most popular candlestick patterns that provide information on the three market sentiments: bullishness, bearishness, and a neutral or tentative market condition.

An example of a complex pattern is the Three White Soldiers, which requires three candlesticks, the Bullish Harami show in the previous example requires two candlesticks, whereas the Bullish 3-Method Formation shown here requires four.

Regardless of the complexity, the location of all these candlestick patterns is one of the most important aspects of understanding candlesticks pattern types.

As you learn to identify and read simple and more complex candlestick patterns, you can begin to read charts to see how you can trade using these patterns.

An example of a candlestick chart in action

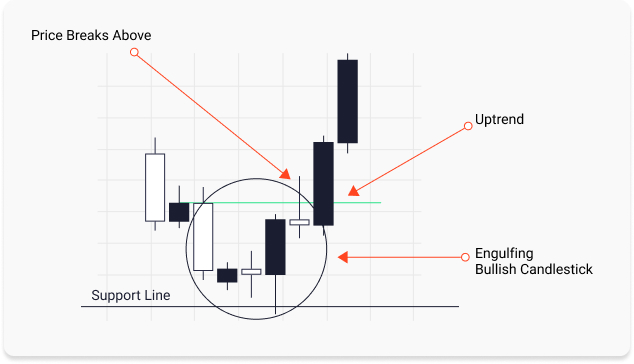

We can see that the GBPJPY price was bouncing around a strong support level, but failed to break below it. It penetrated the support level on the third try, but the market swiftly reversed and formed an Engulfing Bullish Candlestick pattern that signaled further bullishness in the market.

Some beginner traders may recognise the bullish setup and enter a buy order at this point. Professional traders, on the other hand, will probably be waiting for the proper confirmation to enter the trade. This confirmation came on the next day when the GBPJPY price penetrated above the high of this Engulfing Bullish Candlestick — confirming that there would be additional bullishness in the market over the next few days.

The Engulfing Bullish Candlestick at closer inspection

Once the Engulfing Bullish Candlestick formed around this crucial support level, it prompted a significant number of pending buy orders just above the high of this Engulfing Bullish Candlestick. When the price penetrated above the high, it triggered those orders, adding the additional bullish momentum in the market.

When the market consolidates for a while, it is basically setting up to break out in one direction or the other. The formation of this bullish candlestick pattern was the signal as to which way the market was about to break. Traders who understand how to read a simple candlestick pattern like the Engulfing Bullish would have known when to enter this trade, and could have profited with this high reward-to-risk ratio setup.

How you could profit from candlestick trading

Once you learn how to correctly read candlestick patterns, you can use this skill as part of a broader trading strategy. This can improve the consistency of your market entries and your overall performance as a trader.

Candlestick patterns are useful for spotting areas of support and resistance. They are also valuable for confirming your predictions about market movements. However, it is worth mentioning that there is a lot that candlesticks cannot tell you. For instance, you cannot use them to learn why the open and close are similar or different.

Once you master the basics of reading candlestick charts, you potentially can start integrating them into your preferred trading strategy for better accuracy. To use the insights gained from understanding candlestick patterns and investing in an asset, you require a brokerage account.

The best way to get comfortable with using candlesticks in your trading is to open a demo account and start practicing applying your knowledge. As soon as you get comfortable enough in reading candlestick charts for trading, you can open a live account and use your experience to improve your trading performance in the long run.