Best Ways to Invest in Cryptocurrency and Bitcoin

Looking to invest in cryptocurrencies like Bitcoin and Ethereum but aren't sure where to start? You're in luck.

The world of crypto trading can feel like a daunting place - full of technical jargon, complicated charts and unpredictable market movements.

So, to help guide you through these choppy waters, we've compiled a handy, beginner-friendly guide to the different ways you can get exposure to this exciting market.

From low-risk entry points to tactics for experts willing to balance risk and reward, we've compiled the top ways of trading crypto together to help you find the right strategy for you.

- Why Invest in Cryptocurrency?

- Different Ways to Invest in Cryptocurrency

- How to Choose the Best Method for You

- Cryptocurrency Investment Strategies

- Common Pitfalls to Avoid When Investing in Cryptocurrency

- Common cruptocurrency investment FAQs

Why Invest in Cryptocurrency?

Over the past few years, cryptocurrency has grabbed the attention of investors all over the world, and it's easy to see why.

"The zeal for cryptocurrencies has certainly intensified since Donald Trump won the 2024 US presidential elections.

Still, the risk remains whether the president-elect’s campaign promises will translate into actual crypto-friendly policies that foster greater innovation and demand for this asset class.

As long as Trump 2.0 makes good on positioning the US as the “crypto capital of the world”, that should create a conducive environment for cryptos to extend their recent bull run."

For young professionals and those with a bit more money to play with, cryptocurrencies can really help diversify your portfolio beyond the usual stocks and bonds.

Millennials and Gen Z are especially into crypto since it fits their tech-savvy lifestyle and desire for financial independence. At the same time, institutional investors and retirees see it as a way to protect against inflation and currency drops.

With the recent launch of Bitcoin ETFs, getting into cryptocurrency has become even easier for a wider range of people, including older investors who are starting to explore this space.

These ETFs make it simple to invest in Bitcoin without needing to own it directly. As more people start accepting and using cryptocurrencies, they’re becoming a key part of a well-rounded investment strategy.

However, it's important to remember the potential drawbacks, such as market volatility, the risk of hacking and digital theft, and regulatory uncertainties.

It's vital that if you are going to trade crypto, you do so in the right way for you.

Different Ways to Invest in Cryptocurrency

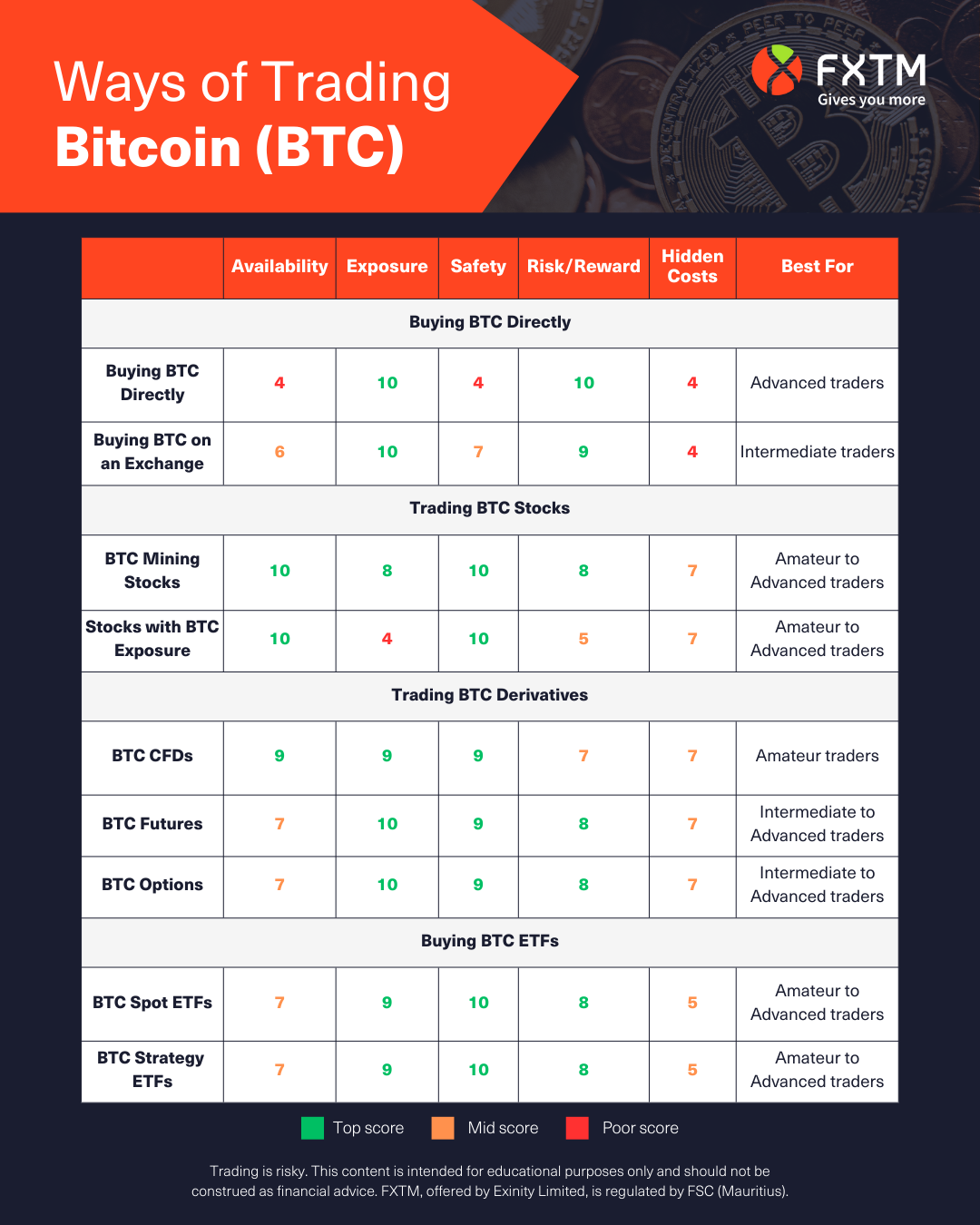

Investing in cryptocurrency can be tailored to your risk tolerance, accessibility needs, and financial goals. Here are the main methods:

1. Buying Cryptocurrency Directly

Buying cryptocurrency directly from an exchange gives you the highest exposure to the asset.

However, it requires setting up an account, understanding cryptocurrency wallet security, and being prepared for high volatility.

If not properly secured, digital wallets can be susceptible to hacking and theft. Unlike traditional bank accounts, once funds are stolen from a crypto wallet, they are difficult to recover.

Some well-known exchanges include Coinbase, Kraken, and Bitstamp.

2. Cryptocurrency Mutual Funds and ETFs

For those who prefer a more hands-off approach, cryptocurrency mutual funds and ETFs (Exchange-Traded Funds) offer an attractive alternative. Bitcoin strategy ETFs invest in futures, while spot ETFs hold the actual asset.

These investment vehicles pool funds from multiple investors to purchase a diversified portfolio of cryptocurrencies or blockchain-related assets.

Here's the key takeaway - Bitcoin ETFs allow you to gain exposure to the crypto market without directly owning cryptocurrency.

3. Investing in Companies with Bitcoin Exposure

Another strategy for gaining exposure to the cryptocurrency market is investing in companies with significant Bitcoin holdings or those actively involved in blockchain technology.

Companies like Tesla and MicroStrategy hold substantial amounts of Bitcoin on their balance sheets. Investing in these companies provides indirect exposure to the cryptocurrency market.

Investing in such companies offers the advantage of benefiting from the growth potential of both the firm and its crypto holdings. It also provides a degree of stability, as the performance of these companies is not solely dependent on cryptocurrency market fluctuations.

However, investors should conduct thorough research and consider the company's overall financial health, business model, and market position before making investment decisions.

Here's the complete list of companies with Bitcoin exposure you can trade at FXTM.

- MicroStrategy

- Marathon Digital

- Tesla

- Coinbase

- Galaxy Digital

- CleanSpark

- Block

- Riot

4. Trading Cryptocurrency CFDs

For those interested in more active trading, cryptocurrency Contracts for Difference (CFDs) offer an exciting option.

Trading crypto CFDs allows you to speculate on the price of cryptocurrencies without owning the underlying asset. CFDs are highly leveraged, making them a high-risk, high-reward strategy

One significant advantage of cryptocurrency CFDs is the ability to use leverage, which amplifies potential gains. However, it’s essential to approach leverage trading cautiously, as it also increases the risk of substantial losses.

You can trade a range of Cryptocurrency CFDs with up to 1:1000 leverage today with FXTM, including Bitcoin, Ether, Ripple and many more.

How to Choose the Best Method for You

There are many factors that affect which method of trading Bitcoin is right for you - significantly your level of risk tolerance and individual goals.

Factors to Consider Based on Risk Tolerance

When deciding on a method for investing in cryptocurrency, considering your risk profile is crucial. Each method - direct buying, ETFs, and CFDs - comes with distinct risk levels and benefits, and understanding these can help guide your decision.

Buying Bitcoin directly:

Buying cryptocurrency directly tends to have a higher risk profile due to market volatility.

Price swings in the crypto market can be extreme, leading to significant gains or losses. Security is also a concern, as securing your digital wallet is imperative to avoid theft.

Availability is relatively high, with numerous exchanges available globally, but financial position considerations are paramount; substantial capital can be tied up directly in cryptocurrencies.

Cryptocurrency ETFs:

Investing through ETFs generally presents a lower risk compared to direct buying since it offers a diversified portfolio and indirect exposure.

ETFs are subject to stock market regulations, which adds an additional layer of safety. They're more available to traditional investors and those looking for minimal interactions with digital wallets.

Financially, ETFs allow a more balanced position, giving flexibility without the need to manage individual crypto assets directly.

Cryptocurrency CFDs:

This method is characterised by its high-risk, high-reward nature, primarily due to the use of leverage.

While CFDs can magnify returns, they also exponentially increase potential losses. CFDs are widely available on trading platforms and often appeal to those with higher risk tolerance and a speculative financial position willing to engage in active trading.

Safety is a concern, as the leverage involved can lead to significant financial injury if not managed carefully.

Ultimately, the choice depends on your risk tolerance, financial standing, availability, and desired level of involvement in managing their investments. Evaluating these aspects can help tailor an approach that aligns with your specific goals.

Best Ways to Invest for Different Personas

1. Young Professionals (25–35)

- Occupation: Tech sector, finance, start-ups

- Income: Mid to high (£40,000+)

Buying BTC directly or on an exchange

Young professionals in tech or finance are likely to be tech-savvy and familiar with digital assets. They may prefer direct exposure to Bitcoin by buying BTC on a crypto exchange or opting for BTC Spot ETFs to balance convenience with regulated investment options.

2. Retirees (60+)

- Occupation: Retired, possibly former business owners

- Income: Moderate (£30,000 - £50,000 pension pot)

BTC Strategy ETFs

Retirees may seek diversified and lower-risk exposure to Bitcoin without direct management. Strategy ETFs, which manage the exposure for them, offer a safer and more predictable way to benefit from BTC's growth potential without having to handle the asset directly.

3. High-Net-Worth Individuals (40+)

- Occupation: Executives, business owners, investors

- Income: High (£100,000+)

Buying BTC CFDs, BTC Futures, or Options

High-net-worth individuals can afford to take higher risks. They may seek direct exposure to BTC or engage in more sophisticated instruments like futures or options to hedge, speculate, or gain leverage over price movements.

4. Middle-Aged Professionals (45–60)

- Occupation: Professionals in established careers (lawyers, engineers, doctors)

- Income: High (£75,000+)

Buying BTC Spot ETFs

Middle-aged professionals likely prefer regulated investment vehicles such as Spot ETFs. This provides exposure to Bitcoin’s price without the complexity of holding and managing digital assets, fitting their risk appetite and investment strategy.

5. Small Business Owners (35–50)

- Occupation: Local business owners, entrepreneurs

- Income: Mid (£50,000 - £75,000)

Stocks with BTC exposure, BTC Mining Stocks

Small business owners may prefer traditional equities with BTC exposure to avoid dealing directly with cryptocurrencies. Investing in companies like Tesla or MicroStrategy, which hold BTC, allows them to indirectly gain from Bitcoin's price movement while staying within familiar equity markets.

6. Corporate Executives (50–65)

- Occupation: C-suite executives, corporate leaders

- Income: High (£150,000+)

BTC Strategy ETFs, BTC Options

Corporate executives may appreciate the structured nature of ETFs but also have the financial sophistication to engage in options trading. Strategy ETFs offer managed exposure, while options trading allows for hedging or leveraging their Bitcoin exposure.

7. Students (18–25)

- Occupation: University or college students

- Income: Low (Under £15,000)

BTC CFDs

With limited capital, students might prefer trading instruments like CFDs, which allow them to speculate on Bitcoin's price with minimal upfront investment. However, CFDs are high risk, so it suits those who may be willing to experiment and learn at low cost.

8. Side Hustlers (25–40)

- Occupation: Freelancers, gig economy workers, part-time entrepreneurs

- Income: Mid (£20,000 - £40,000)

Buying BTC on a crypto exchange

Side hustlers are likely flexible and tech-savvy. They may prefer buying Bitcoin directly on exchanges like Coinbase or Kraken for easy access and liquidity, balancing their medium income with potential long-term growth.

9. Wealthy Retirees (65+)

- Occupation: Retired professionals with significant assets

- Income: High (£100,000+ retirement / pension pot)

BTC Strategy ETFs

Wealthy retirees with large retirement pots might prefer low-effort, regulated Bitcoin exposure via Spot ETFs or Strategy ETFs, offering capital growth without the need for hands-on management.

10. Stay-at-Home Parents (30–45)

- Occupation: Stay-at-home parent, part-time work

- Income: Low to mid (£5,000 - £10,000)

Stocks with BTC exposure, BTC CFDs

Stay-at-home parents might prefer the safety of traditional stocks with BTC exposure, like Tesla or MicroStrategy, which can provide indirect gains from Bitcoin without the volatility of holding the asset themselves. Using CFDs with leverage can also give them access to the market with a lower upfront cost, provided they set the appropriate stop-loss controls.

Cryptocurrency Investment Strategies

Beyond selecting how you'll trade Bitcoin, you'll also need to find a sensible investment strategy.

Developing a coherent investment strategy is crucial for success in the volatile crypto market.

Long-term investors might prefer holding Bitcoin in wallets, while short-term traders can take advantage of price fluctuations with CFDs or ETFs.

Diversifying your portfolio with a mix of methods can also mitigate risk.

Here are some popular strategies to consider:

Buy and hold:

The simplest approach is buying and holding Bitcoin for the long term, anticipating its value will increase significantly in the future. This strategy requires patience and belief in the long-term potential of cryptocurrency.

Dollar-cost averaging:

With this method, investors regularly invest predetermined amounts into Bitcoin, regardless of market price fluctuations. This approach reduces the risk of timing the market and can help build a consistent investment over time.

Swing trading:

This strategy involves buying when prices are low and selling when they're high, taking advantage of short-term price swings. This method requires active monitoring of the market and is more suited for experienced traders.

Hedging:

Investors can also use Bitcoin to hedge against economic downturns or inflation by using it as a diversification tool in their portfolio.

Common Pitfalls to Avoid When Investing in Cryptocurrency

While the potential for high returns in cryptocurrency is enticing, investors must be aware of common pitfalls.

FOMO (Fear of Missing Out)

One significant risk in today’s fast-paced world is succumbing to FOMO (Fear of Missing Out), which can lead to impulsive and often misguided decisions.

This feeling is intensified by the constant barrage of information and trends circulating on social media platforms, where it’s easy to feel pressured to jump on the latest bandwagon.

To mitigate this risk, it’s crucial to conduct thorough research and take the time to evaluate investment opportunities carefully.

You can make more informed decisions by analysing market fundamentals and trends rather than making choices based solely on hype or fleeting social media buzz.

Hidden Costs

Hidden costs have historically been part and parcel of investing in bitcoin.

Unregulated and regulated exchanges have been known to charge high commissions, fees and other expenses in order to transact in bitcoin- network fees, wallet fees and exchange and conversion fees.

However, as regulations have increased, especially after the numerous scandals we have seen in recent years like at FTX, many of these hidden costs are becoming more transparent with less opaque charges becoming the norm.

You should be aware of fee structures when dealing with cryptocurrency exchanges as this can vary significantly across platforms. Some might charge network fees which are essentially transaction fees paid to miners for confirming the transaction on the blockchain.

Also note that withdrawals can come with fees which may change, according to the congestion of the network.

FREQUENTLY ASKED QUESTIONS

There is no one-size-fits-all answer to this question, as the best cryptocurrency investment depends on individual financial goals and risk tolerance. Bitcoin, as the pioneer cryptocurrency, remains a popular choice due to its market dominance and widespread acceptance. However, other cryptocurrencies like Ethereum, Cardano, and Solana offer unique features and growth potential.

Investors should conduct thorough research and consider factors such as market trends, technology, and community support before making investment decisions. Diversifying investments across multiple cryptocurrencies can also reduce risk and increase exposure to various opportunities.

The choice between a Bitcoin Trust, ETF, or direct ownership depends on individual preferences and financial goals. Directly owning Bitcoin provides full control and potential benefits from holding the digital asset. However, it also requires secure storage and active management.

Bitcoin Trusts and ETFs offer convenience, professional management, and increased liquidity. They are suitable for investors seeking exposure to Bitcoin without the complexities of direct ownership. It’s essential to consider factors such as fees, accessibility, and investment strategy when making a decision.

Yes, several Bitcoin ETFs have been approved in different jurisdictions. In the United States, the first Bitcoin futures ETF, the ProShares Bitcoin Strategy ETF (BITO), was launched in October 2021. Several other countries, including Canada and Brazil, have approved Bitcoin ETFs that directly hold the cryptocurrency.

It’s important to research and monitor regulatory developments in your jurisdiction, as the availability of Bitcoin ETFs varies by region. Consulting with a financial advisor can provide valuable insights into the best ETF options for your specific needs.

Investing in cryptocurrency can be worthwhile for beginners, provided they approach it with caution and education. The crypto market offers significant growth potential, but it’s important to understand the associated risks and volatility.

Beginners should start with small investments and gradually increase exposure as they gain experience and confidence. Utilising educational resources, joining online communities, and seeking guidance from experienced investors can enhance understanding and mitigate risks.

Check out our guide to trading cryptocurrency for beginners to get started.

The appropriate starting amount for investing in cryptocurrency varies based on individual financial circumstances and risk tolerance. It’s recommended to start with an amount you can afford to lose, as the crypto market can be highly volatile.

For beginners, a modest investment of $100 to $500 can provide valuable experience without exposing them to significant financial risks. Gradually increasing investments as knowledge and confidence grow can lead to successful long-term strategies.

Conclusion

Cryptocurrency offers a compelling opportunity for investors seeking diversification and growth. By understanding the best ways to invest in cryptocurrency and tailoring strategies to individual needs and risk tolerance, investors can maximise their potential in this dynamic market.

Whether you’re a young professional ready to explore the world of digital assets, a retiree seeking new investment avenues, or a high-net-worth individual looking to diversify your portfolio, the key lies in education, diversification, and informed decision-making.

References

- Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. Retrieved from https://bitcoin.org/bitcoin.pdf

- Hougan, M., & Lawant, M. (2021). Cryptocurrency Investing: A Guide for Serious Investors. Journal of Investment Strategies, 9(3), 123-145. Retrieved from [Journal of Investment Strategies](https://www.journalofinvestmentstrategies.com)

- Securities and Exchange Commission. (2021). SEC Approves Bitcoin Futures ETF, Providing Regulatory Framework. Retrieved from https://www.sec.gov/news/press-release/2021-123

Ready to trade with real money?

Open accountPut your knowledge to the test

Start trading with a leading broker that gives you more.