Non-farm payrolls

Find out what the non-farm payrolls (NFP) report is, when it’s released and how it affects financial markets.

Trading is risky.

Latest non-farm payrolls data

May 2025: The US economy added 139,000 jobs in May, slightly above market expectations of 130,000. US unemployment remained at 4.2%.

Latest

139,000

Forecast

130,000

Previous

147,000

When is the next non-farm payrolls report?

NFP data is usually released at 8.30am (EST) on the first Friday of every month.

Here are the key dates for your diary.

| Reference Month | Date | Time (EST) |

|---|---|---|

| January 2025 | 7 February 2025 | 8.30am |

| February 2025 | 7 March 2025 | 8.30am |

| March 2025 | 4 April 2025 | 8.30am |

| April 2025 | 9 May 2025 | 8.30am |

| May 2025 | 6 June 2025 | 8.30am |

| June 2025 | 11 July 2025 | 8.30am |

| July 2025 | 8 August 2025 | 8.30am |

| August 2025 | 5 September 2025 | 8.30am |

| September 2025 | 10 October 2025 | 8.30am |

| October 2025 | 7 November 2025 | 8.30am |

| November 2025 | 5 December 2025 | 8.30am |

| Reference month | January 2025 |

|---|---|

| Date | 7 February 2025 |

| Time (EST) | 8.30am |

| Reference month | February 2025 |

| Date | 7 March 2025 |

| Time (EST) | 8.30am |

| Reference month | March 2025 |

| Date | 11 April 2025 |

| Time (EST) | 8.30am |

| Reference month | April 2025 |

| Date | 9 May 2025 |

| Time (EST) | 8.30am |

| Reference month | May 2025 |

| Date | 6 June 2025 |

| Time (EST) | 8.30am |

| Reference month | June 2025 |

| Date | 11 July 2025 |

| Time (EST) | 8.30am |

| Reference month | July 2025 |

| Date | 8 August 2025 |

| Time (EST) | 8.30am |

| Reference month | August 2025 |

| Date | 5 September 2025 |

| Time (EST) | 8.30am |

| Reference month | September 2025 |

| Date | 10 October 2025 |

| Time (EST) | 8.30am |

| Reference month | October 2025 |

| Date | 7 November 2025 |

| Time (EST) | 8.30am |

| Reference month | November 2025 |

| Date | 5 December 2025 |

| Time (EST) | 8.30am |

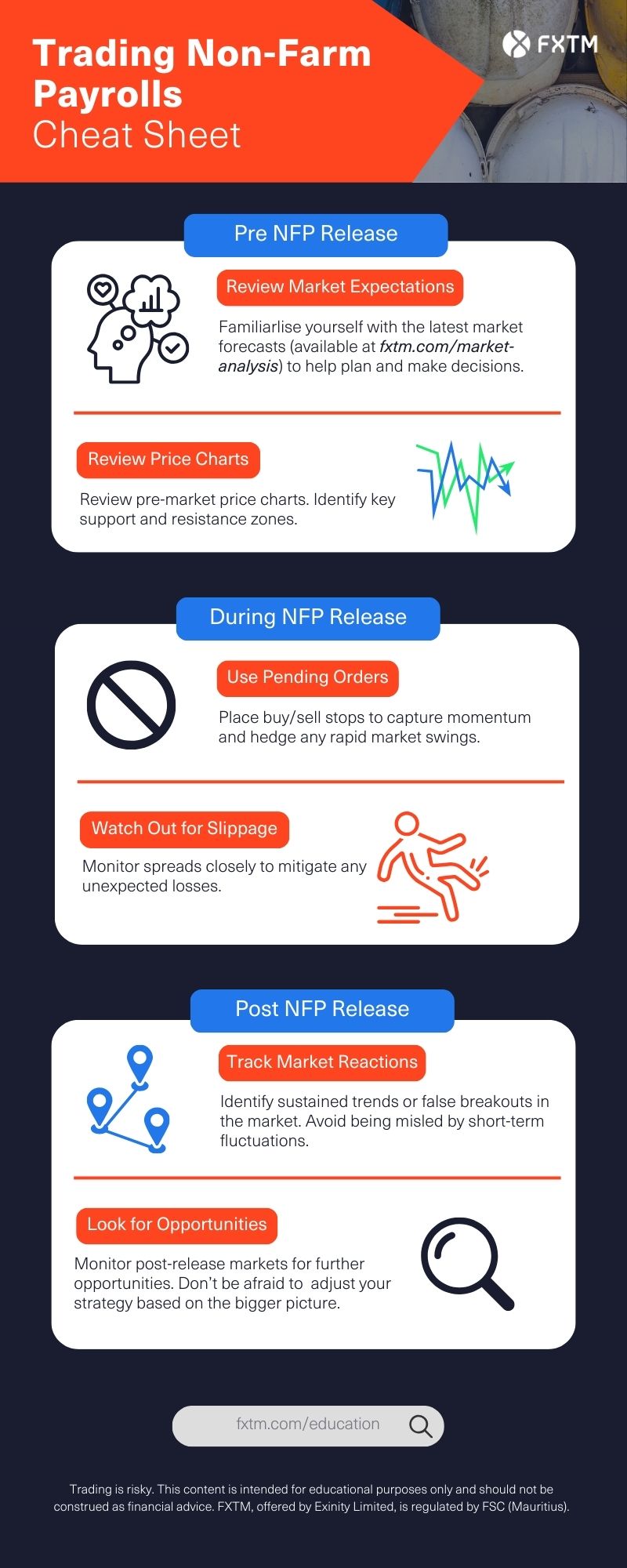

How to trade non-farm payrolls

Traders take a keen interest in the non-farm payrolls as it’s historically caused sudden, significant price movements in the market, giving rise to potential trading opportunities.

Economists will attempt to predict what the headline NFP figure will be each month, usually arriving at a consensus estimate. If the actual figure deviates significantly from the estimate, this tends to create more market volatility.

The US dollar, US indices and commodities such as gold are particularly sensitive to the NFP report.

How to trade non-farm payrolls cheatsheet

Week Ahead: US30 index still sensitive to US recession fears

Market “Olympics”: Best-performing financial assets so far in 2024

Why are Stock, FX, Crypto markets falling?

Why trade non-farm payrolls with FXTM?

More Analysis

Get free daily market analysis and trade ideas straight to your inbox.

More Value

Trade for less with spreads from zero, flexible commissions, and no account fees.

More Tools

Build your trading strategies with advanced platforms on desktop, web, and mobile.

More Opportunities

Access hundreds of trading instruments across FX, indices, commodities and stocks.