Like a rampant bull, the dollar trampled most G10 currencies this week and climbed to a fresh 25-month high above 103.00!

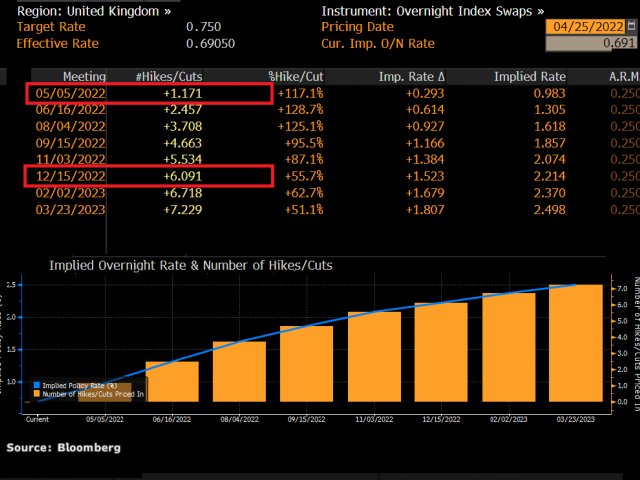

Market expectations over the Federal Reserve aggressively raising interest rates and demand for safe-haven assets continue to empower dollar bulls.

There are several key data points over the next few days which could move the dollar even further. It may be wise to keep a close eye on the US Q1 GDP figures, US weekly initial jobless claims, and PCE deflator among other reports. Should the pending data reinforce market expectations of tighter Federal Reserve policy, the dollar could tighten its grip on the FX throne.

An appreciating dollar has triggered some big movements in various currency pairs. Below, we use technical analysis to uncover these opportunities and potential setups over the next few days.

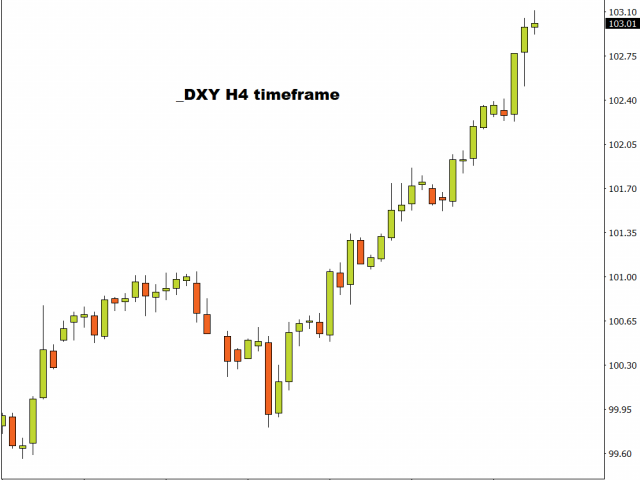

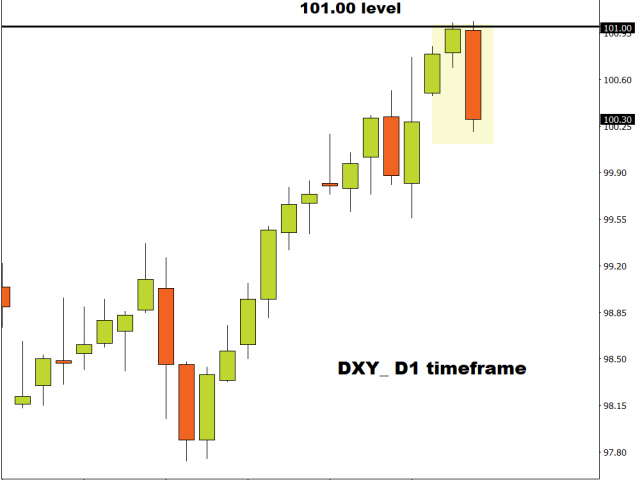

Dollar Index sprints higher

The dollar's explosive appreciation is akin to a speeding train reaching maximum velocity with fundamentals keeping the engines running at maximum capacity! Bulls are certainly in a position of power with the DXY hitting the 103.00 level. A strong breakout and daily close above this point could open the doors towards 103.96 – the peak of 2020.

Should 103.00 prove to be reliable resistance, a decline back towards 101.00 could be on the cards.

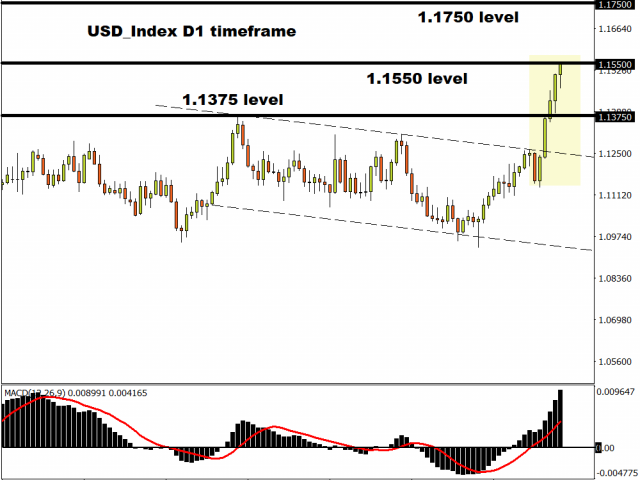

Equally weighted USD Index eyes 1.1550

The daily chart says it all. Prices are bullish on the daily timeframe as there have been consistently higher highs and higher lows. A strong break above 1.1550 could encourage a move towards 1.1750 – a level not seen since June 2020!

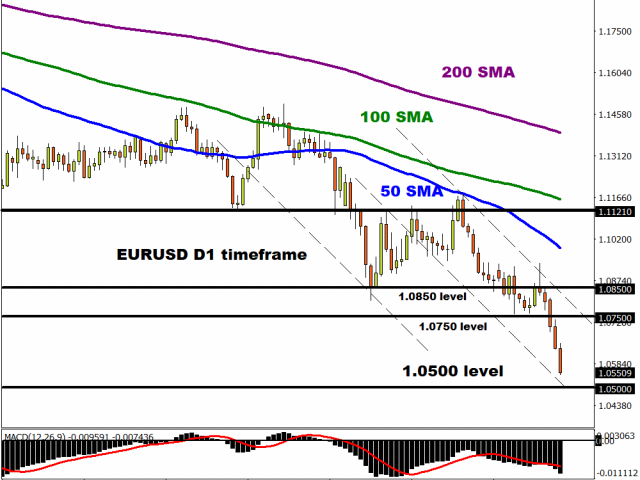

EURUSD tumbles towards 1.0500

EURUSD has dropped over 250 pips since the start of the week! Prices are trading below the 50, 100, and 200-day Simple Moving Average while the MACD trades below zero. The downside momentum could take prices towards 1.0500. A break under this level may signal steeper declines.

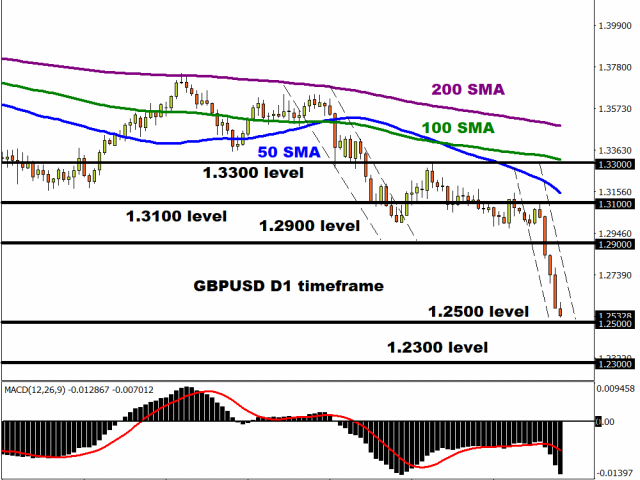

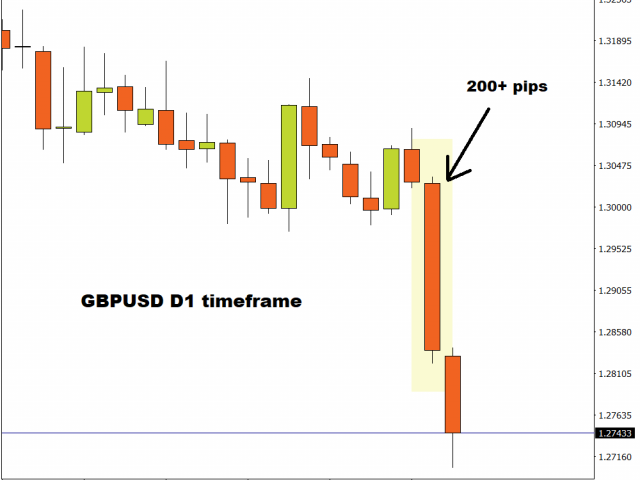

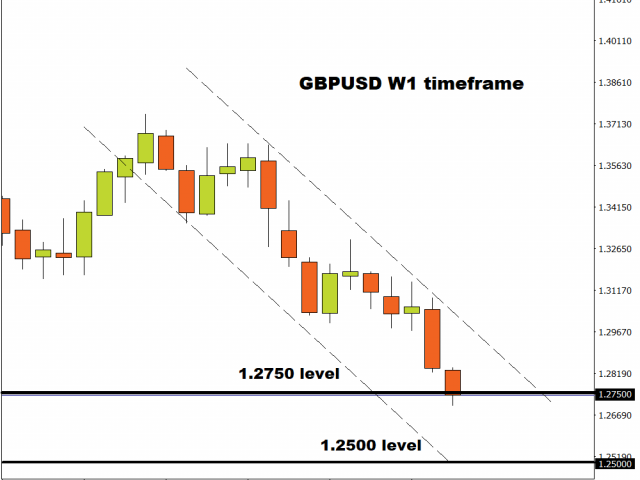

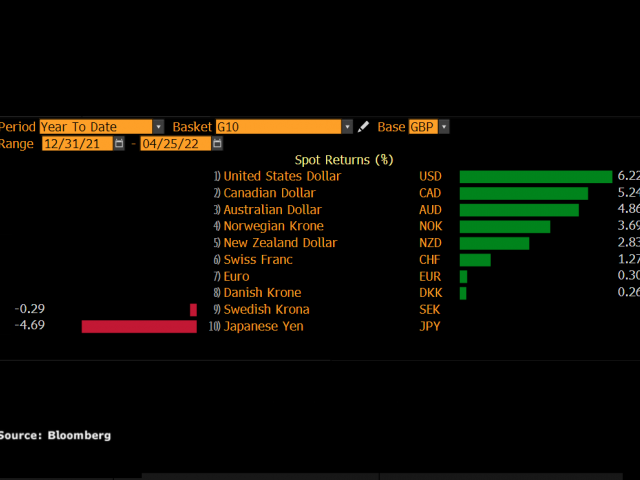

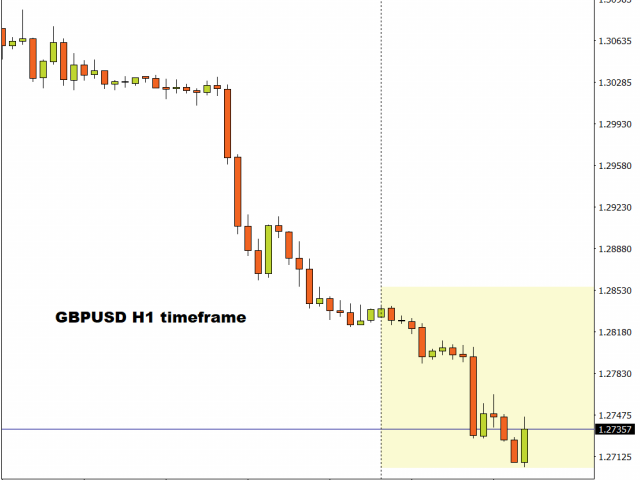

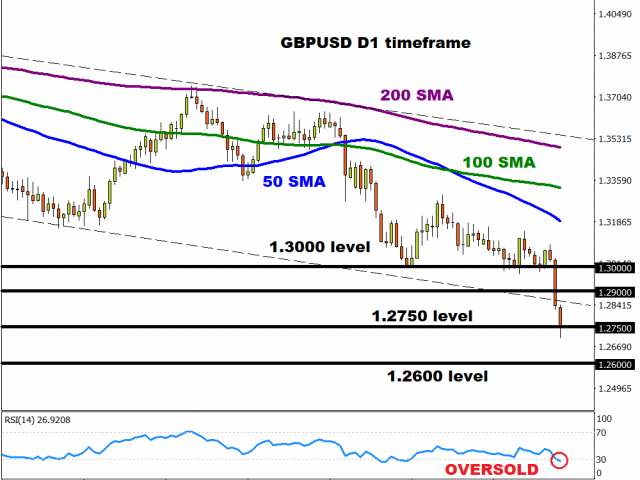

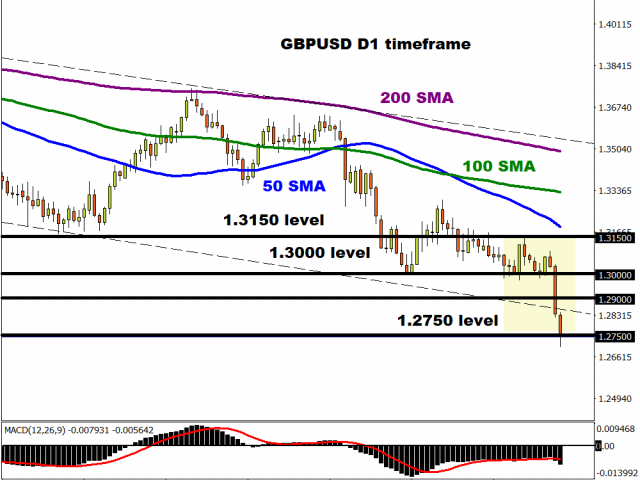

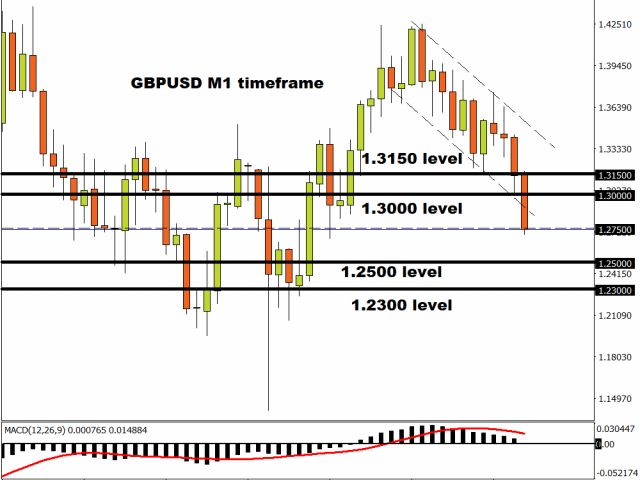

GBPUSD descends into the abyss

The past few days have been pretty rough for the pound. It has weakened across the board, shedding over 3% versus the dollar since last Friday. Looking at the charts, the GBPUSD is under intense pressure. A solid breakdown and daily close below 1.2500 could encourage a selloff towards 1.2300.

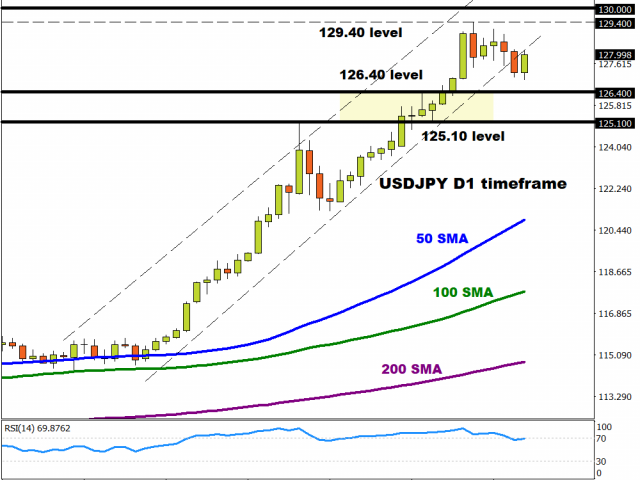

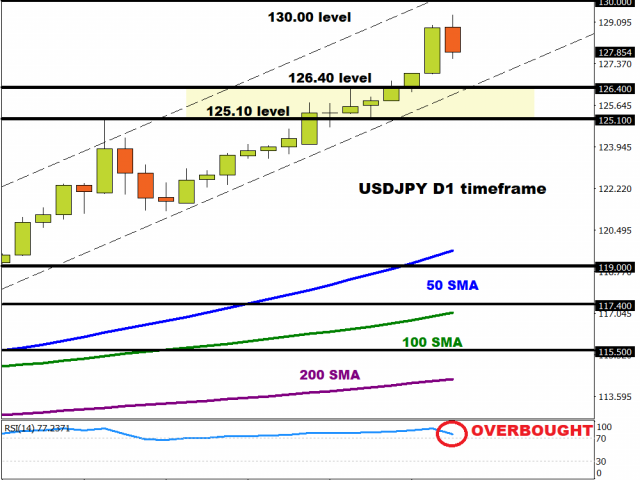

USDJPY to hit 130?

Prices remain heavily bullish on the charts with the next key level of interest at 130.00. A breakout above 129.40 could signal a move towards 130.00. Should prices decline back under 126.40 could open a path back towards 125.10.

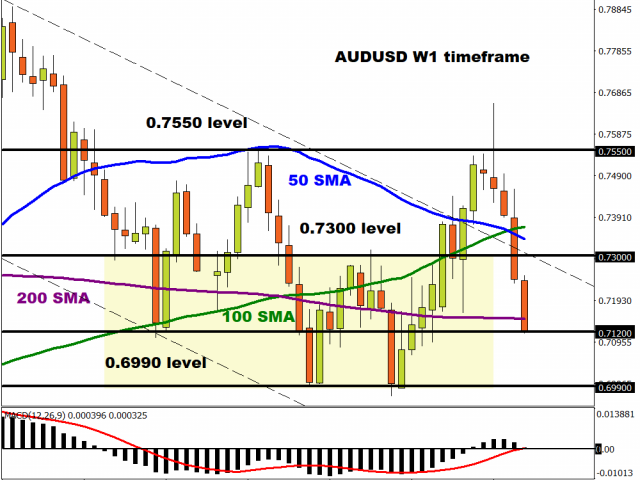

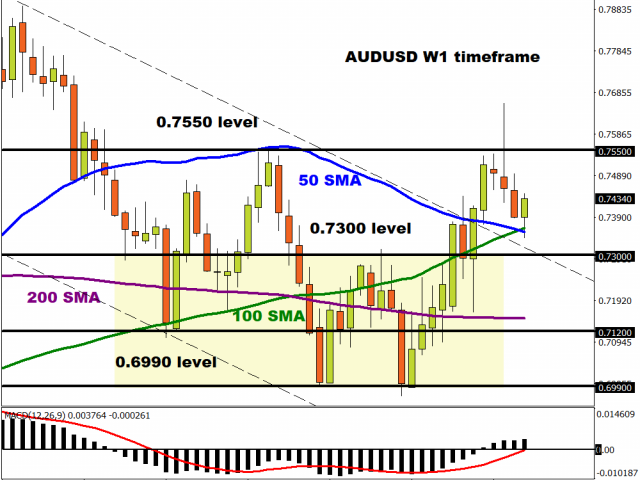

AUDUSD slams through 200-week SMA

After securing a weekly close below 0.7300, Aussie bears have stepped into higher gear with prices slamming into 0.7120 yesterday. A strong move below this point could trigger a selloff to 0.6990.

USDCAD aims for 1.2900 resistance

Since the breakout from the 1.2650 resistance level, the USDCAD has pushed higher with 1.2900 acting as a key level of interest. Beyond this point, bulls could aim for 1.3000. If the upside momentum runs out of steam and 1.2900 proves to be reliable resistance, prices may decline back towards 1.2700-1.2650 before resuming the uptrend.

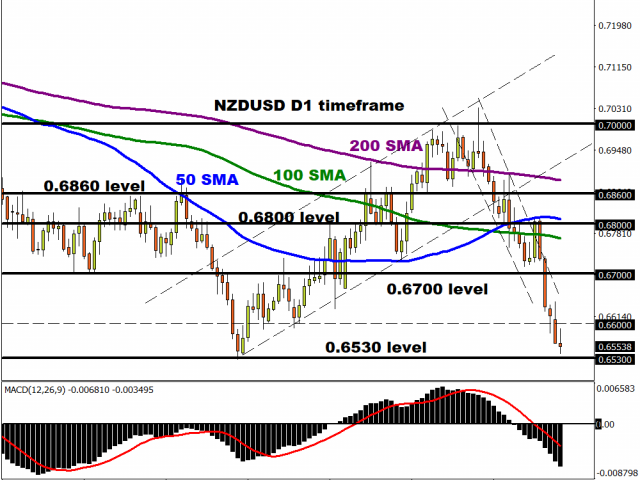

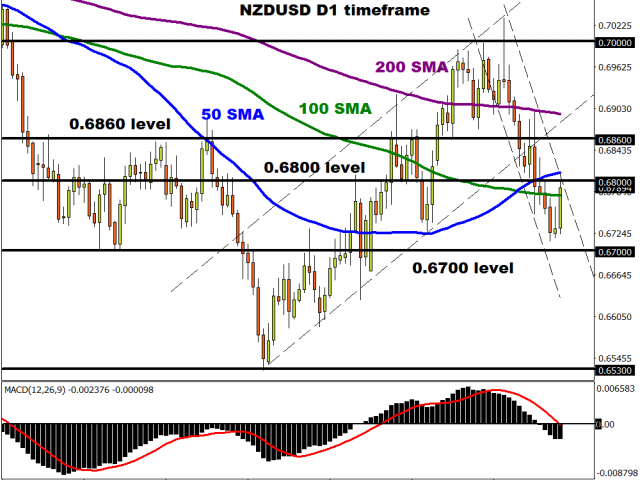

NZDUSD targets 0.6530

The NZDUSD is heavily bearish on the daily charts. Bears are on a tear with the next key level of interest at 0.6530. Below this point, bears may target 0.6400. Investors should not rule out the possibility of a technical bounce back towards 0.6600 before the downtrend resumes.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.