Global equities staged a rebound on Wednesday after days of turmoil and uncertainty over Russia’s invasion of Ukraine.

The mood across markets slightly improved as investors placed hopes on EU leaders fending off a recession caused by geopolitical risks. In the commodities arena, gold prices reversed course to dip below $2000 while oil bulls took the day off. There was action across the FX space as the dollar and yen weakened with the EURUSD among other currency pairs snatching our attention. Volatility has certainly been the name of the game over the past few days. While this comes with risk, it also presents potential setups across equity, foreign exchange, and commodity markets.

There are a couple of jewels and gems hidden beneath all the noise. However, technical analysis remains a suitable tool to unearth these opportunities.

EURUSD breakout or throwback?

It may be wise to keep a close eye on how the EURUSD behaves around 1.1121 on Thursday.

With the European Central Bank (ECB) widely expected to leave interests rates unchanged and the dollar drawing strength from the overall uncertainty, the EURUSD is poised to decline. Given how prices are approaching a key dynamic level, anything could be on the table. A strong breakout above 1.1121 may open the doors towards 1.1320. Alternatively, sustained weakness under 1.1121 could trigger a decline back towards 1.0850.

GBPUSD above major resistance

If you want clarity on the GBPUSD, just take a look at the weekly charts.

Prices remain in a bearish weekly channel and there have been consistently lower lows and lower highs. Strong support can be found at 1.3100 which is also where the 200-week Simple Moving Average resides. Should bears secure a weekly close below this support, a decline back towards 1.3000 and lower could be on the cards. Alternatively, a rebound from this level could signal a move to 1.3430 and potentially higher.

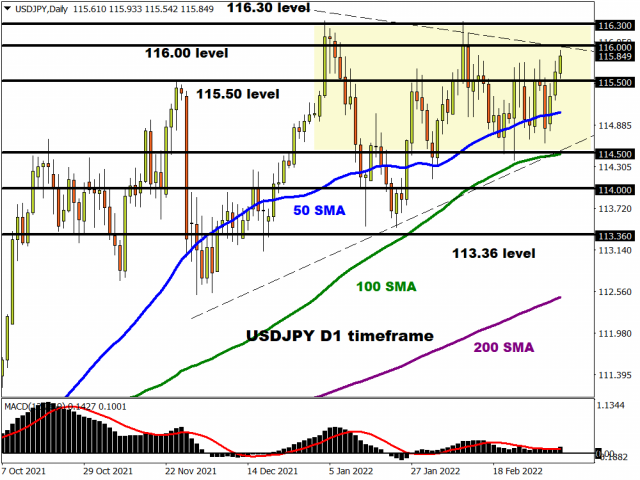

USDJPY same old story

It’s the same old story for the USDJPY. Prices remain trapped within a range with multiple levels of support and resistance levels on both sides. The currency pair needs a fresh directional catalyst and this could come in the form of the pending US inflation report on Thursday. In the meantime, a breakout above 116.00 could open a path towards 116.30 and 117.40. If prices slip below 115.50, then the next level of interest can be found at 114.50.

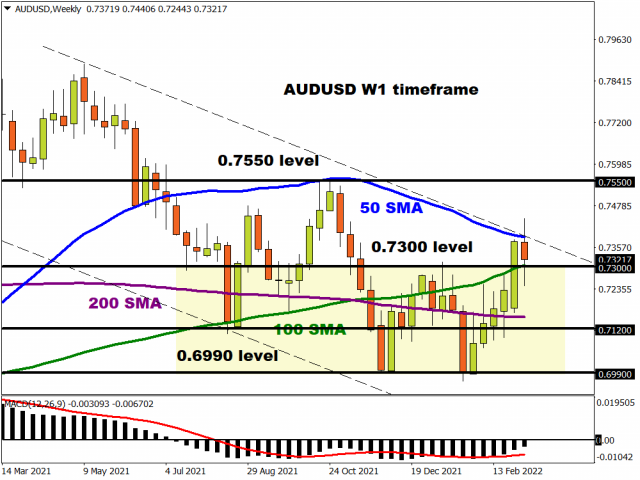

AUDUSD bears still lingering

The AUDUSD experienced a rebound over the past few weeks with bulls pushing the currency beyond 0.7300. Interestingly, prices still remain in a bearish channel on the weekly charts with 0.7300 acting as a pivotal point. Sustained weakness under this level could trigger a selloff towards 0.7120 and 0.6990.

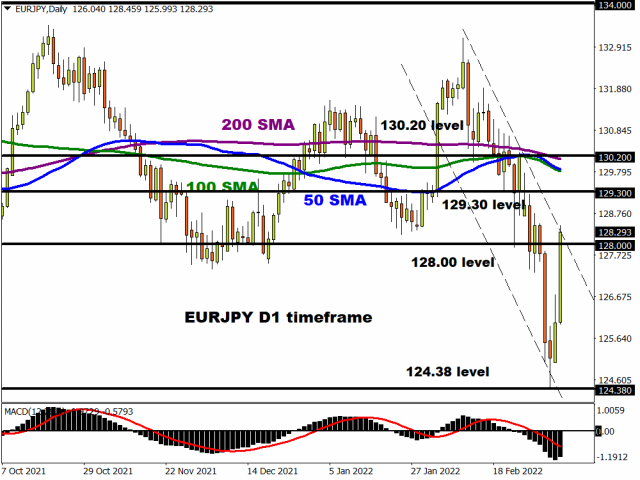

EURJPY trend reversal?

The EURJPY has jumped over 200 pips today thanks to a weakening Japanese Yen. Prices could turn bullish on the daily charts if a strong daily close above 129.30 is achieved. A selloff back below 128.00 may trigger a steep decline towards 124.38.

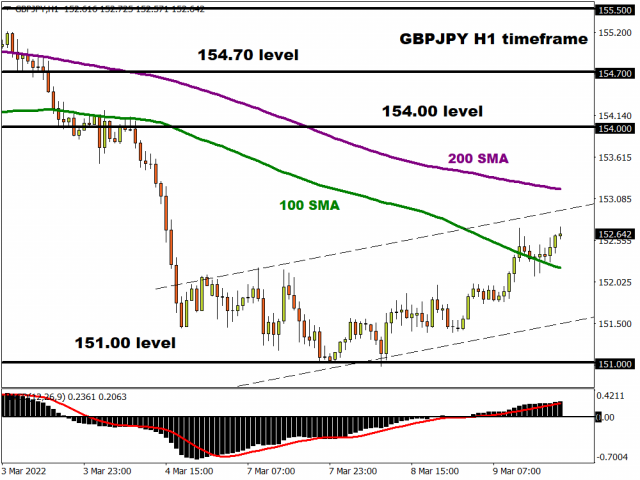

GBPJPY to push higher on shorter timeframe

Things are looking bullish for the GBPJPY on the hourly charts. The upside momentum could take prices to 153.30 and 154.00 before bears re-enter the scene. A move below 152.20 could trigger a selloff towards 151.00.

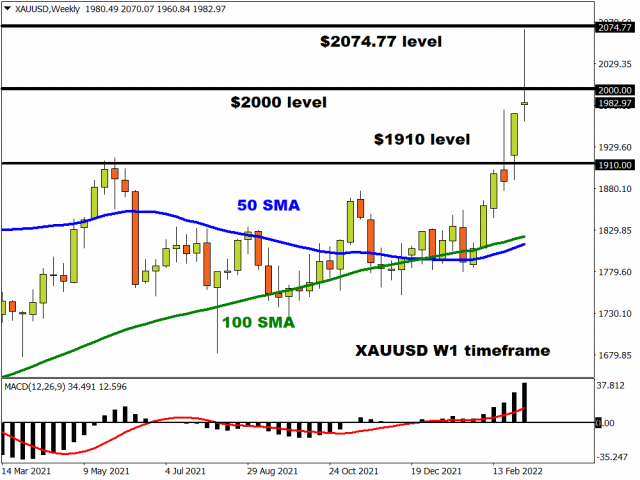

Is the party over for gold bugs?

They say a picture says 1000 words. Well, then check out gold on the weekly timeframe. The forming pin bar on the weekly charts is bad news for bulls with a weekly close back below $2000 signalling further downside. It is worth keeping in mind that gold prices may be influenced by the US inflation report on Thursday.

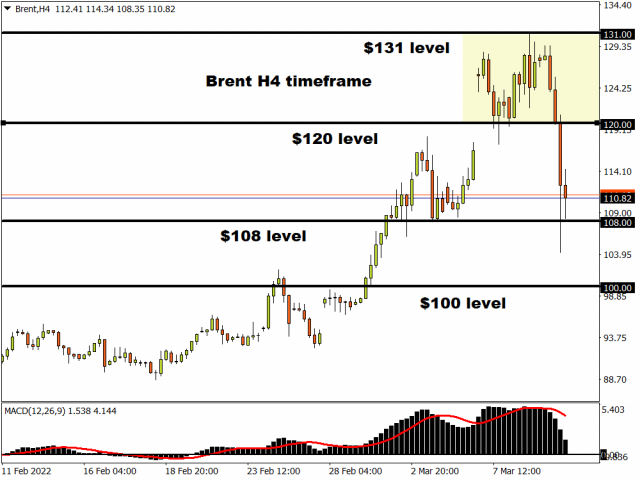

Oil bulls twist ankles

Yesterday we questioned whether oil bulls were unstoppable? It looks like they have tripped over something or injured themselves today as prices tumble. Brent crude is trading around the $108 level after punching above $131 on Tuesday. A strong breakdown below $108 is likely to encourage a decline back towards $100.

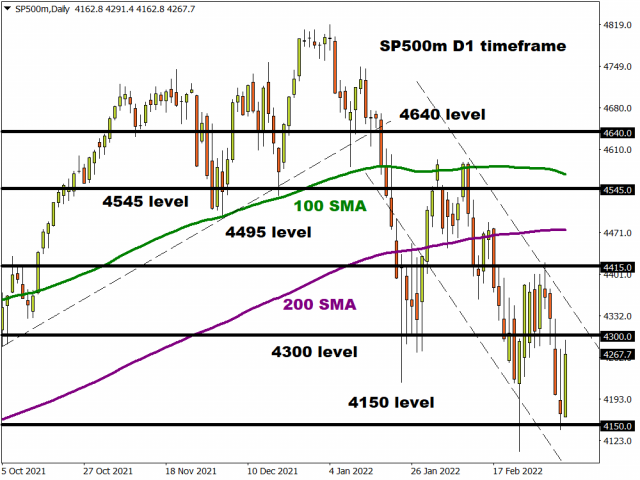

S&P500 respects bearish channel

Despite today’s sharp rebound, the S&P500 remains in a bearish channel on the daily charts. If 4300 proves to be reliable resistance, a decline back towards 4150 and lower could become reality. Above 4300, the next key levels of interest can be found at 4415 and 4470 – a level just below the 200-day Simple Moving Average.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.